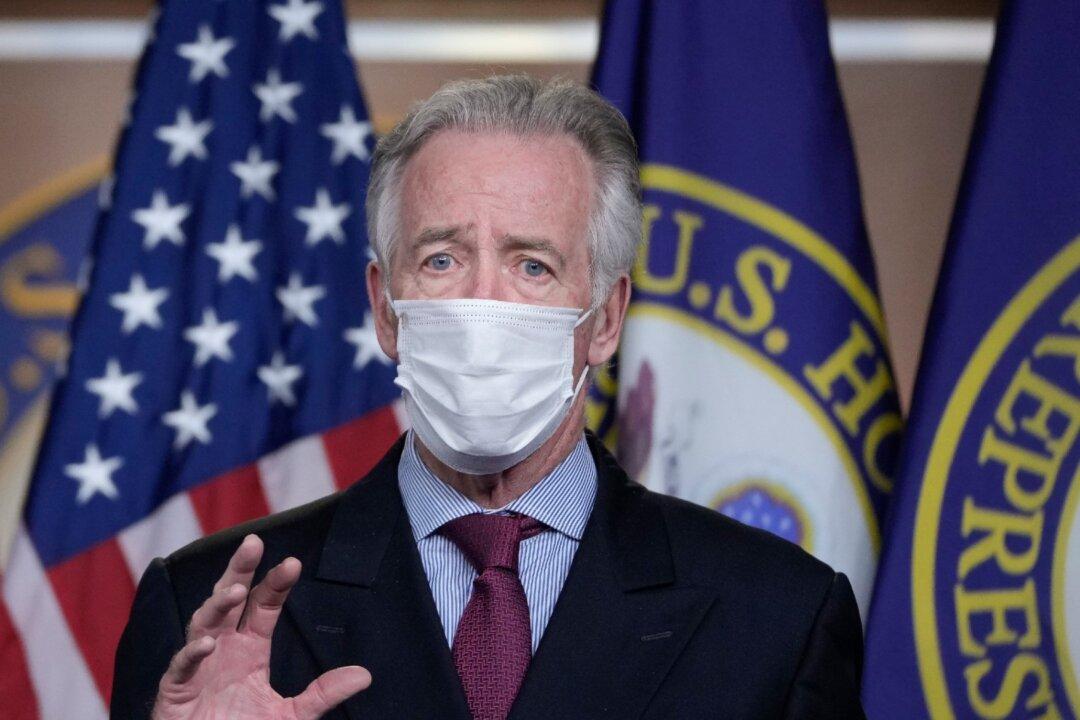

Republicans including the Ranking Member of the House Ways and Means Committee Kevin Brady (R-Texas) say Democrats’ plan to raise revenue in an attempt to pay for their $3.5 trillion spending package will increase taxes for small businesses as well as low and middle-class families, while Democrats argue it will only impact the very wealthy.

“It is devastating tax hikes on main street small businesses, just as they’re trying to come out of the COVID, plus, they double the death tax. There’s and a number of family-owned businesses and farms that will be hit by the death tax, and then finally President Biden, clearly, breaks his pledge by raising taxes on low income and middle-class families,” said Brady during an interview with Fox News on Monday.