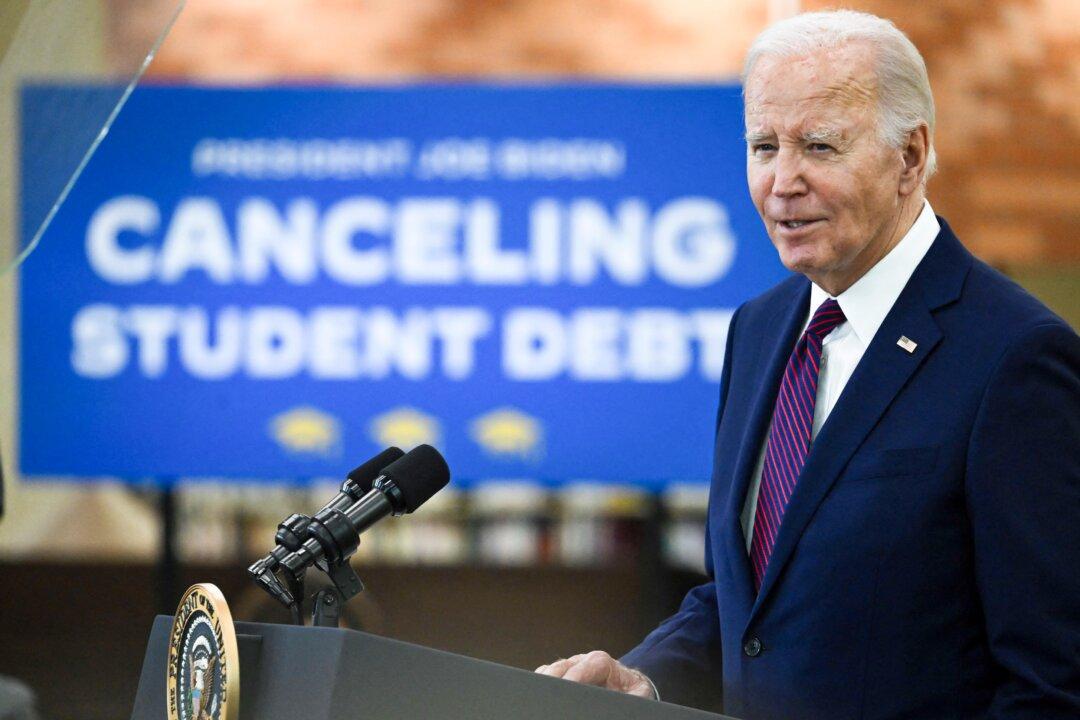

A federal judge on Oct. 3 blocked President Joe Biden’s student loan cancellation plan, one day after a different judge said he would not extend a block on the program.

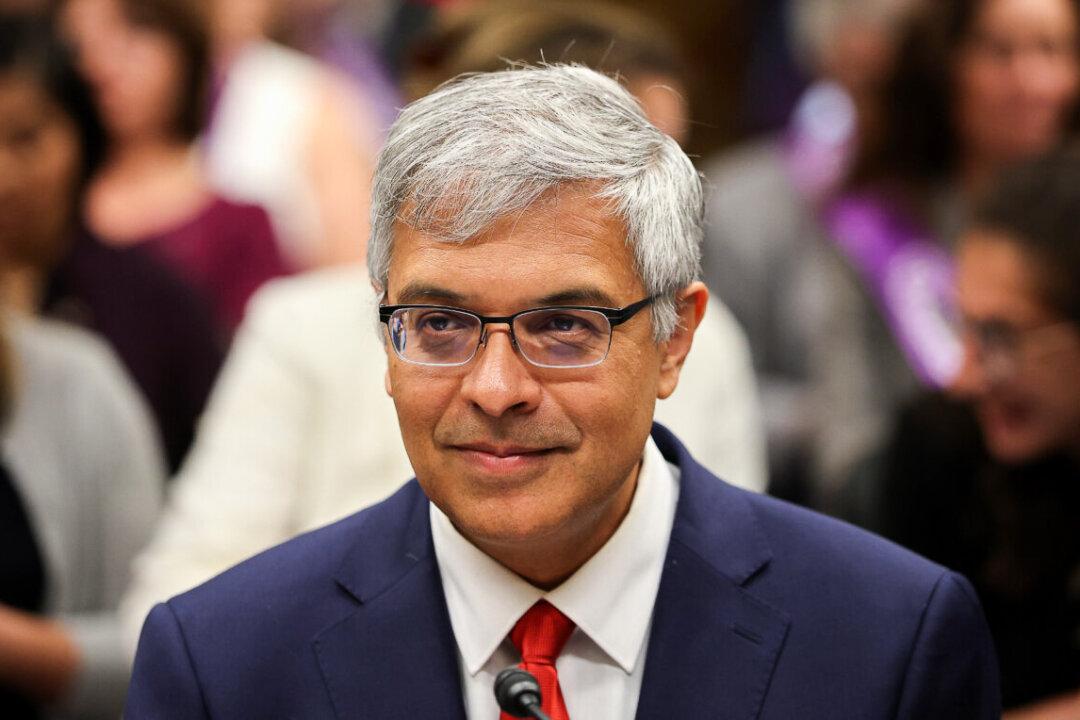

U.S. District Judge Matthew Schelp, citing an earlier appeals court decision in a case against a separate loan cancellation plan, said that plaintiff states that sued over the program will be irreparably harmed if he did not enter a preliminary injunction against it as the case moves forward.