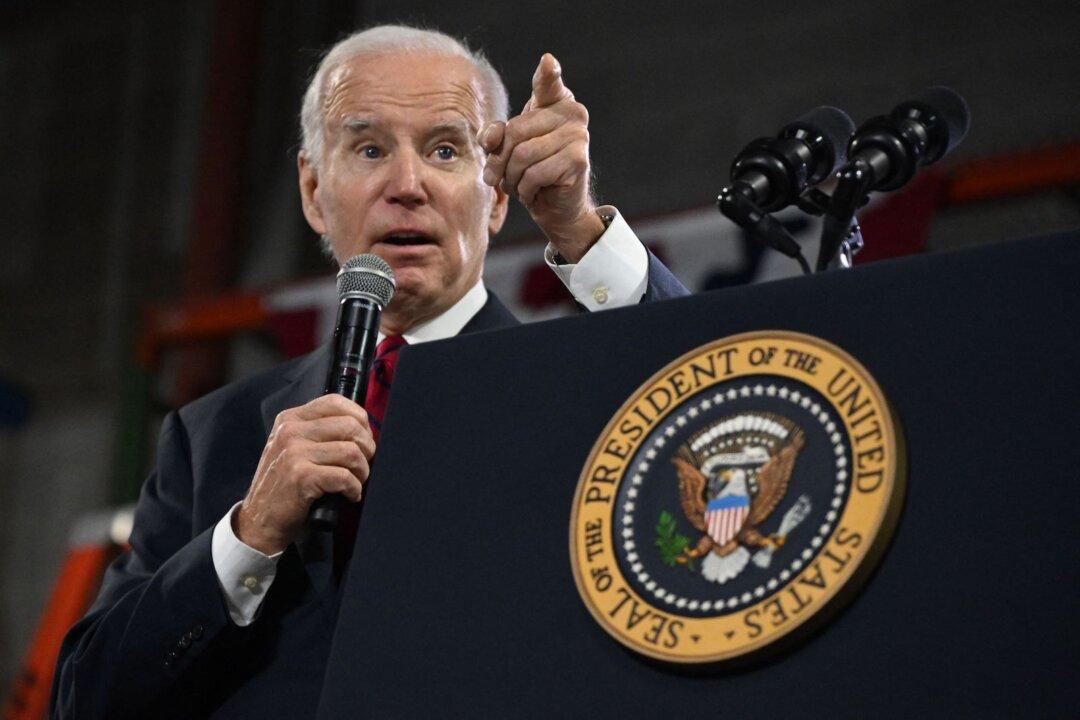

The Biden administration’s new Department of Labor (DOL) rule allowing 401(k) managers to invest in Environmental Social Governance (ESG) funds will harm two-thirds of America’s retirement accounts, according to Kansas Attorney General Kris Kobach in an interview that aired on Newsmakers by NTD and The Epoch Times on Feb. 1.

Kobach said that the Jan. 30 change was being done “in the name of this left-wing partisan agenda.”