WASHINGTON—The Chinese communist regime has recently signaled that it could leverage its dominance in rare earth minerals, a threat that has prompted the Biden administration to take action to reduce U.S. reliance on China for rare earths that are used in everything from smartphones to electric vehicles to fighter jets.

Today, China is the dominant global supplier of the minerals, a group of 17 chemical elements used in the production of critical components of key technologies, which could easily be used as a weapon against other countries in a trade war or a conflict.

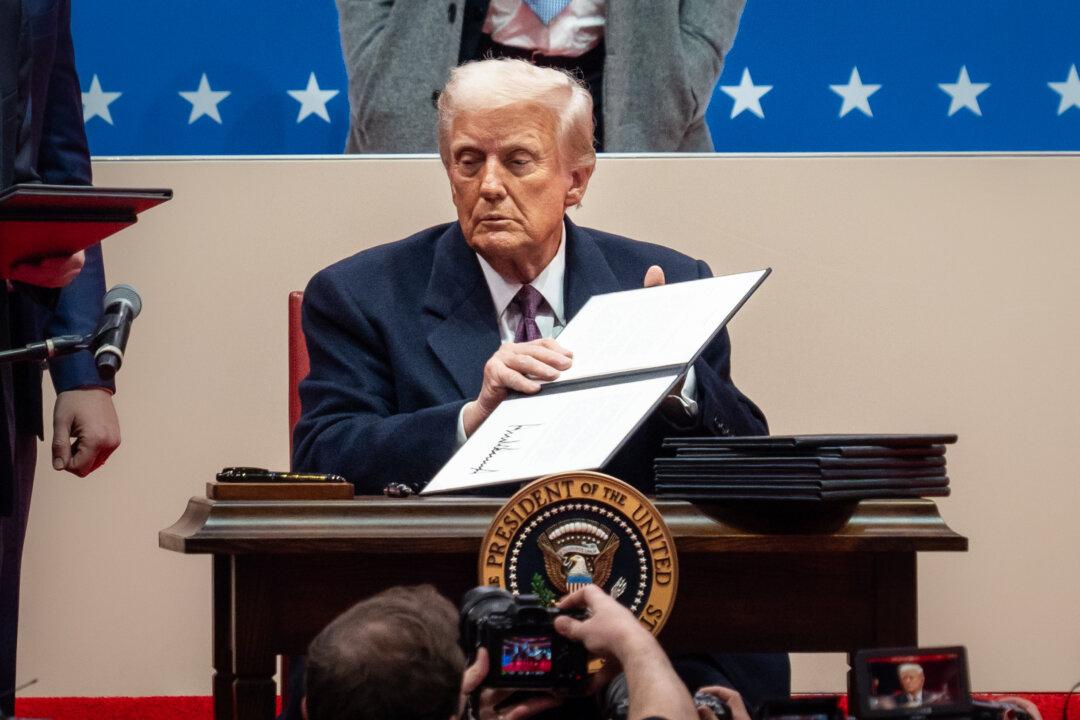

The order focuses on choke points in the supply chains of four key products, including rare earth minerals, semiconductor chips, large-capacity batteries for electric vehicles, and pharmaceutical ingredients.

It directs federal agencies to immediately conduct a 100-day review to identify supply chain risks and vulnerabilities for these key products.

Julie Swann, a supply-chain expert who heads North Carolina State University’s Department of Industrial and Systems Engineering, told The Epoch Times: “We don’t even know the full extent of the vulnerability, or the potential impact. I think this is just the beginning.”

According to Swann, there are likely other products and supply chains that will come under review as the administration continues to detect more vulnerabilities.

It’s unclear what actions the administration will take following the review; however, there are different options depending on the product.

“We’re expecting we’ll be using a mix of incentives to encourage production here. We’re looking at ways to ensure there’s surge capacity available for things that might need to be ramped up quickly—stockpiling,” he said.

He added that the administration would also consider working with allies and partners to take collective actions to address future supply shocks.

Rare Earths Are Abundant

Rare earths play a vital role in many industries including consumer electronics, green technologies, medical tools, and defense. Rare earth magnets, for example, are used in many hybrid and electric vehicles. These metals are also key to the production of weapon guidance systems, jet engines, sonar devices, and laser weapons.The elements are abundant and easy to mine; they are called “rare” because they are difficult to separate and refine into a usable form.

China can “absolutely” limit exports of rare earths to the United States, according to Lewis Black, CEO of Almonty Industries, a Canada-based mining company that specializes in tungsten, a rare metal.

“The mechanism to do so has always been in place and was recently strengthened in December 2020 with new laws that allowed the state to stop exports if deemed in the national interest,” Black told The Epoch Times, referring to Beijing’s new export control law, which came into effect on Dec. 1, 2020.

To counter this threat, the United States has the potential to catch up and expand the mining and refining domestically.

“Rare earths are plentiful, but it’s really a question of whether local communities would welcome a mine opening up nearby,” Black said.

The processing required to produce the minerals is environmentally challenging and also threatens human health.

“Mining left the United States in part not just because of cost but also for the optics as communities often objected to the presence of a mine,” Black said.

The biggest hurdle, he noted, would be reassuring the public that these mines can operate safely and environmentally responsibly.

“Most people have heard or seen horror stories regarding older mines, and given mining has not been a dominant industry in the USA for a generation, this reeducation of the public regarding modern methods will take time,” he said.

Japan Conflict

Beijing abruptly cut off rare earth exports to Japan during a diplomatic clash in 2010 after a Chinese fishing boat collided with two Japan Coast Guard ships in the East China Sea. The export ban sent the prices for raw materials through the roof. The huge price spike worked against Beijing, as it encouraged new production in countries such as Australia and destroyed demand for Chinese metals.The resulting supply chain disruption led Japan, the United States, and the European Union to jointly launch in 2012 a dispute settlement case through the World Trade Organization, which ruled against China two years later.

An increase in prices led to an influx of capital in the mining industry, which helped kick-start mining projects in other parts of the world. However, this exploration boom was short-lived as the supply threat passed and the prices came down.

“That’s also the case now,” according to Harvard Business School professor Willy Shih.

The U.S. Department of Defense on Feb. 1 awarded more than $30 million to Australia’s Lynas Rare Earths Ltd. to build a Texas processing facility.

Last year, the U.S. firm MP Materials also received Pentagon funding for its rare earths separation facility in California.