The Matrix Movies’ Millions Causes Australian Investors to Take Legal Action

Besides being a box office hit, “The Matrix” film’s went on to greater success as the best-selling DVD of all time.

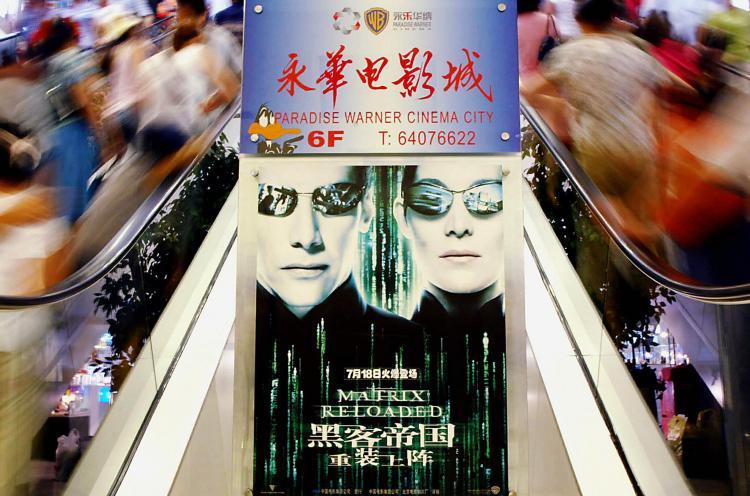

Chinese cinemagoers flock to the new Shanghai's Paradise Cinema for the premier of 'The Matrix Reloaded' in Shanghai 13 July 2003. STR/Getty Images

|Updated: