At one point in time, Hong Kong was undeniably one of the world’s greatest cities. Low tax rates, proximity to other Asian countries, good for weekend getaways, and high life expectancy rate, to name a few attributes. Above all, Hong Kong boasted itself as one of the “freest cities” on earth—a great international financial center in Asia. As a hedge fund professional who spent 20 years of my working life in Hong Kong until mid-2021, I won’t dispute that front. That was the “old Hong Kong” model when things were still intact.

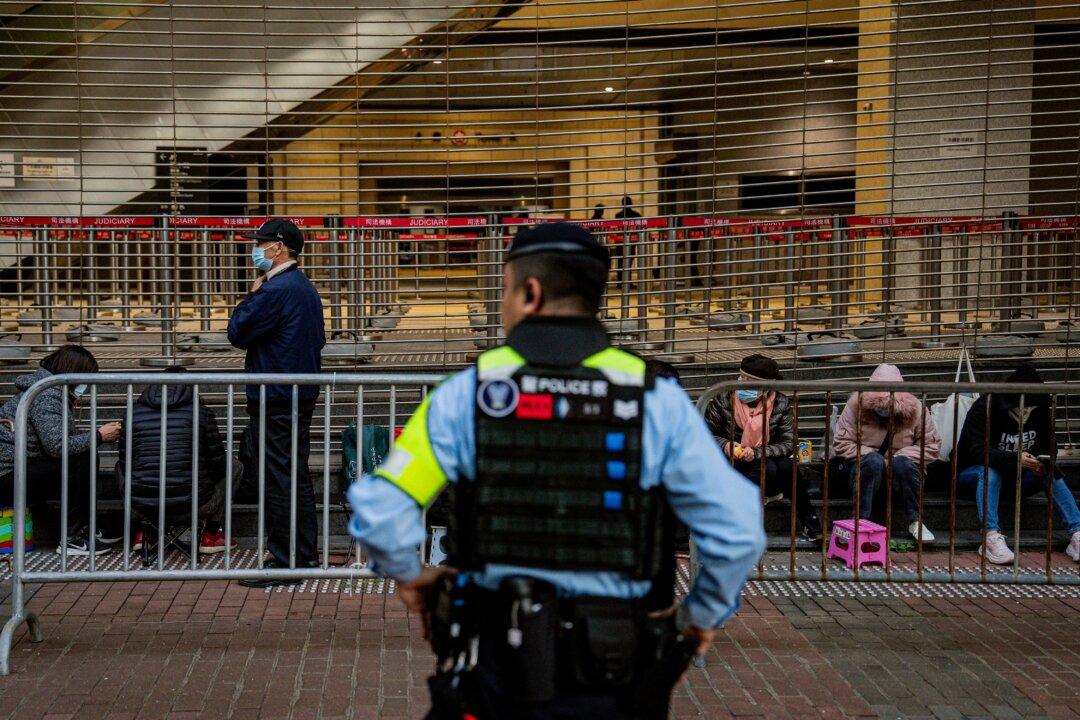

With the enactment of the National Security Law (NSL) effective June 30, 2020, the last 2 and a half years of changes in Hong Kong have been brutal. The extreme makeover politically drags down the city, and it has gradually turned itself into a police state. The rule of law in Hong Kong is destroyed, and the “one country, two systems” model is now more a myth and a joke. In the name of national security, the “factotums” of Hong Kong, as described by a recent opinion piece in The Wall Street Journal about media tycoon Jimmy Lai’s unjust trial, the totalitarian regime has brought down the reputation of the once famed financial city to an all-time low.

It astounded me when Hong Kong Stock Exchange (HKEX) announced that Next Digital, the parent company of Apple Daily, founded by media tycoon Jimmy Lai and a political detainee, will be delisted on Jan. 13, 2023. The international legal team of Jimmy Lai, with a presence in the U.K., recently requested a meeting with U.K. Prime Minister Rishi Sunak. Lai’s trial is supposed to take place in September 2023. The Hong Kong government quickly responded after Lai’s U.K. lawyers and son Sebastian Lai met up with a U.K. foreign office junior minister. The Hong Kong government made a public statement saying that the international legal team of Lai’s from London “wanted to undermine Hong Kong’s rule of law and interfere with the city’s judicial independence.”

Nothing can be further from the truth. Lai is facing multiple charges under the National Security Law (NSL) because Lai is a prominent business and democratic figure that has been risking his life to resist tyranny. The propaganda machine from communist Hong Kong and communist China has discredited him and other prominent dissidents. The only “crime” that was committed by Lai was that they wrote thought-provoking pieces about the Chinese Communist Party’s policies and called for the genuine “one country, two systems” to return. But we are dealing with a ruthless regime here. The ultimate goal is to silence all critics through fear, imprisonment, or confiscation of assets. The confiscation of passports to help the NSL police “investigate” means arbitrary arrests and detainment inside Hong Kong. The tactics of detention and harassment make the business community worry, and those who are doing international business with and inside Hong Kong have to assess carefully the different risks involved.

We are at the beginning of 2023, and the Chinese New Year is approaching. The Hang Seng Index, which measures the performance of the Hong Kong stock market, has recovered from the recent lows of 15,000 points in late October 2022 to the current trading index level of around 21,000. With the “floodgate” opening up from China to Hong Kong after the 180-degree turn in the COVID-19 policy, there is a general perception that mainland visitors to Hong Kong will boost the economy through lavish consumer spending. It is also reported that state-owned banks from China with Hong Kong subsidiaries are luring deep-pocket mainland visitors to open bank deposit accounts in the city. If your deposit is at least HKD$4 million (approximately $513,000), the mainland visitor receives a free COVID-19 mRNA jab of the Pfizer Biotech vaccine, which is generally unavailable inside mainland China. The first bank to promote this is China Citic Bank Corp, a state-owned bank. Looking further into Citic Bank’s promotions, wealthy visitors from the mainland can also enjoy a 15 percent discount at the famous Four Seasons Hotel, and one can test drive a luxurious Bentley. A pretty good gimmick to lure wealthy individuals from communist China.

In the new Hong Kong under the NSL, a high degree of autonomy no longer exists. The loyalists urge Hongkongers to embrace the new law, but at the same time, the rights of the people are further diminished. The city is not dead, it has transformed into something else. The “Lion Rock Spirit” of Hongkongers used to breed opportunities, and sadly, businesses are already turning to their “Plan B” to exit, fleeing in all directions, and setting up shops in Singapore, Taiwan, and Japan, where the rule of law is still intact.

Lastly, on a broader scale, Chinese leader Xi Jinping’s relations with neighboring countries are not at their best. I am afraid a huge geo-political earthquake might unravel in Asia soon, with China being on the offensive, including the intention of taking back Taiwan by force. If China decides to attack Taiwan, what is the role of Hong Kong? Would Beijing trust the people of Hong Kong well enough, under the almost defunct “one country, two systems,” that the big bosses up north would regard Hongkongers as “one of them?” Because Beijing cannot prove every Hong Konger’s allegiance, would there be a further crackdown in the city? If Taiwan is being attacked, the timing and final opportunity for Hongkongers to get out, assuming they can get out, should be carefully thought through. A doomsday scenario for Hong Kong should be on everyone’s mind before it is too late.