Commentary

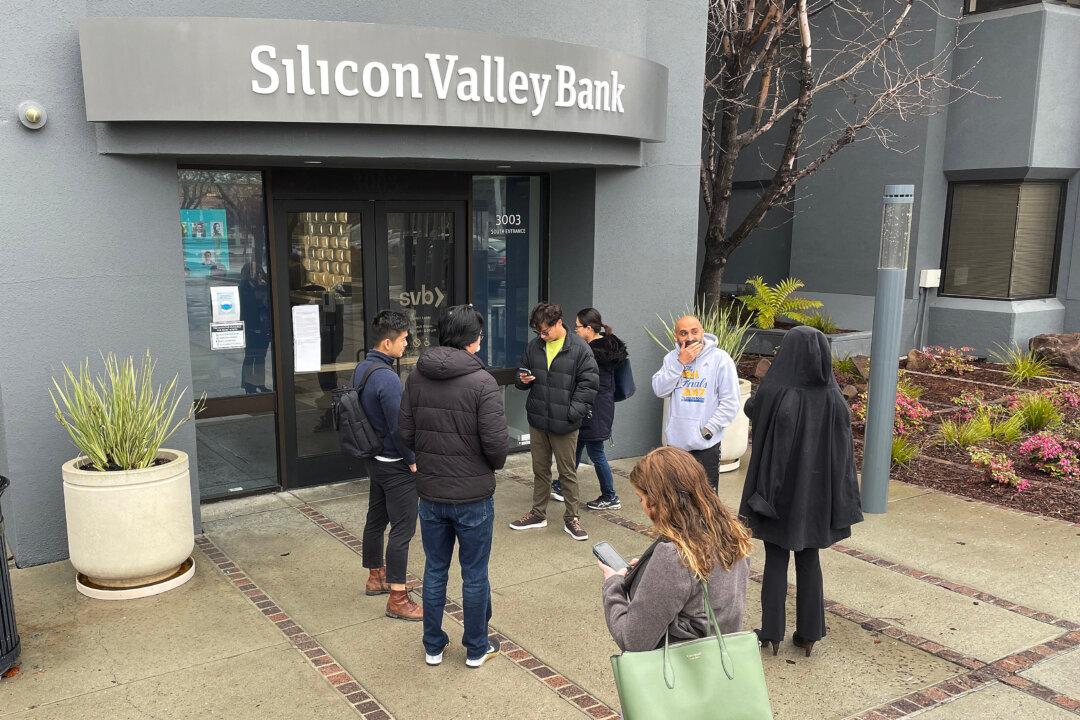

The world economy has been on a perilous road for over a decade. The Global Financial Crisis (GFC) that hit the world in full force in September 2008 led central bankers and the government to issue extraordinary measures to stop the financial sector from melting down.