Sponsored Content

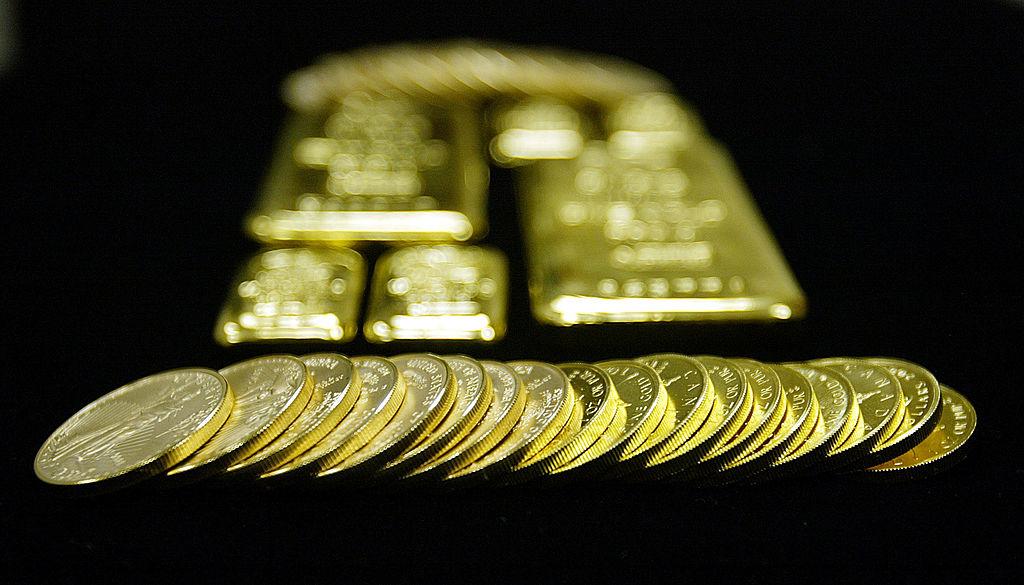

How much value has the U.S. dollar lost over the past 100 years? From 1921 to 2021, the greenback shed 93.5 percent of its value. That’s a loss of 0.93 percent per year. Disturbing? Then you probably haven’t heard the most recent report from the U.S. Bureau of Labor Statistics (BLS).