Everyone is feeling the pain of inflation. It’s hitting us hard in the pocketbook. And although the definition of recession has been put into question, it seems as if more analysts are coming to a consensus that the worst of the economy has yet to emerge.

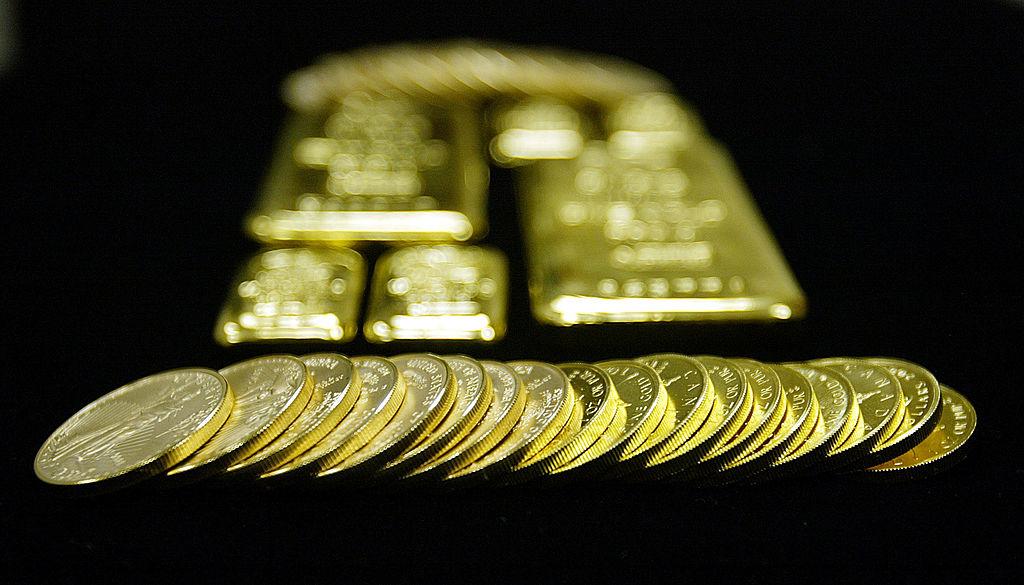

Naturally, American households are worried about their financial future. The specter of 2008 isn’t all that far behind. And even if we’re dealing with a different set of circumstances, the fear of depleting wealth and a crashing economy still remains. And like many situations in which economic uncertainty has prevailed, the flight to gold to protect wealth is increasing once again.