WASHINGTON—The Supreme Court has accepted a case from Montana in which it will consider whether states are allowed to deny tax credit programs to students who opt for religious private schools.

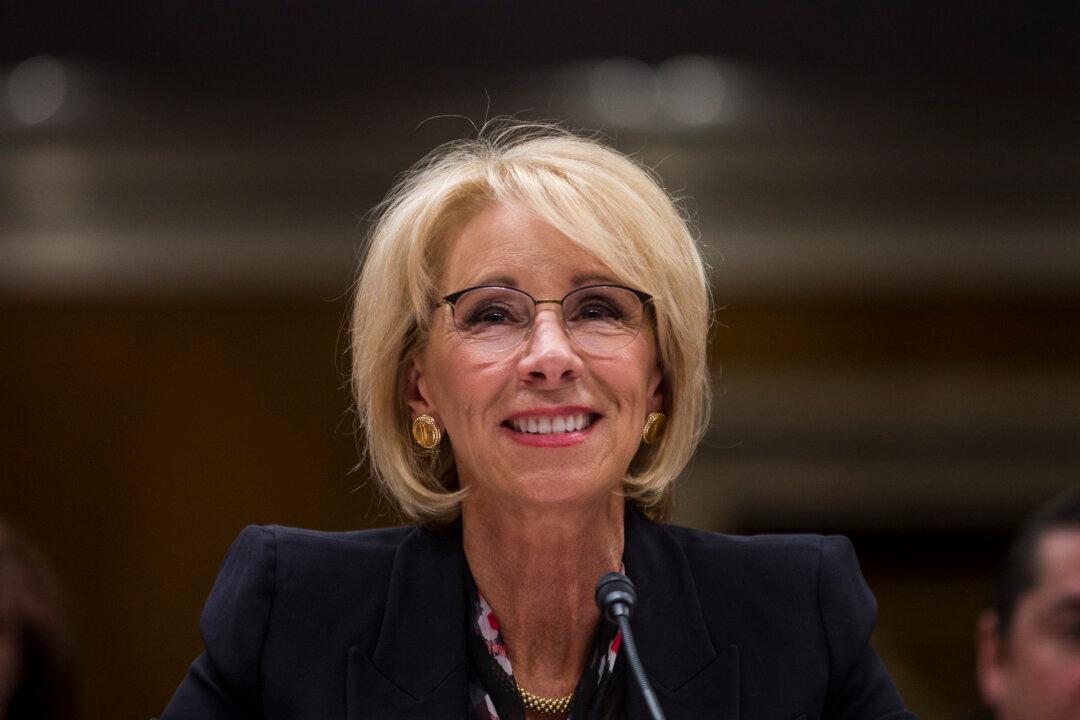

The decision to take the case gives a shot in the arm to the private-school choice movement, which hasn’t made much progress at the federal level in recent years, even though tax credit scholarships are a high-priority agenda item for U.S. Secretary of Education Betsy DeVos.