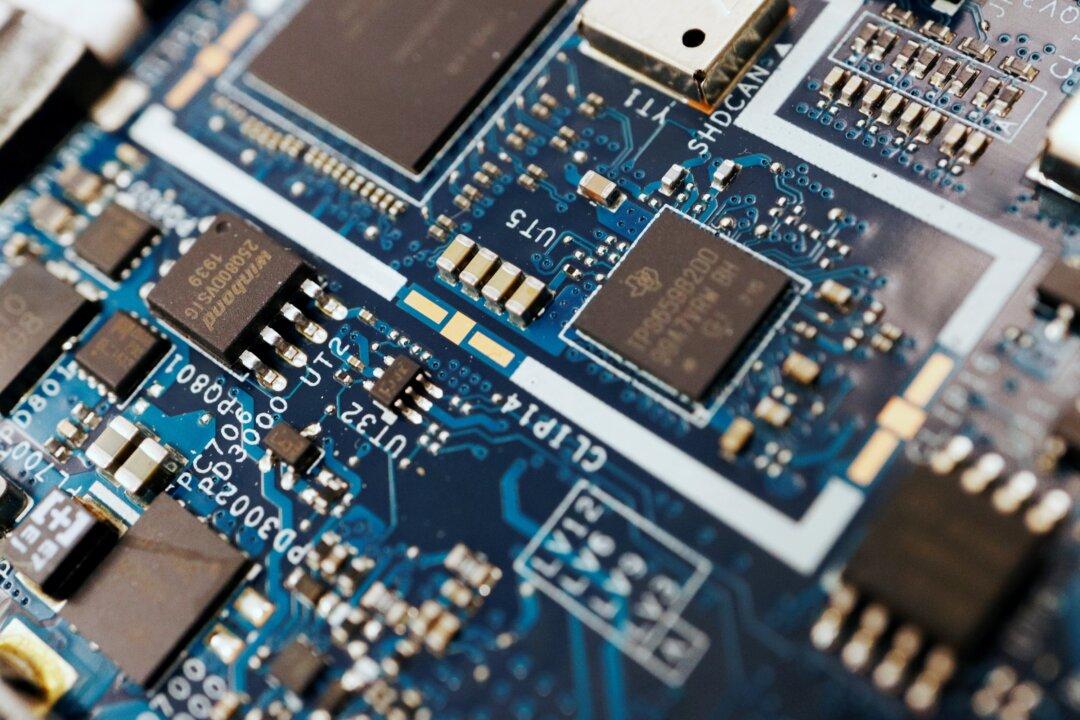

The two-year pandemic had caused a severe supply chain shortage of computer chips for manufacturers of computers, smartphones, and cars.

But in three weeks from the end of May to June, things began to quickly change, as higher inflation, pandemic-inspired lockdowns in China, rising fuel prices, and the conflict in Ukraine, lowered consumer spending, especially in the supply-sensitive electronics market.

The blows on the market from the war in Ukraine to the Chinese lockdowns have driven down chip prices and a pile-up of excess inventories, though experts caution that the glut is confined to certain sectors.“While the semiconductor shortage is starting to abate in a few areas—notably consumer electronics like mid-tier phones or PCs—industry-wide we’re still very far from a glut, and concerning shortages continue to persist in a number of very important sectors of the industry,” said Stephen Ezell, vice president for global innovation policy at the Information Technology and Innovation Foundation (ITIF) told The Epoch Times.