Commentary

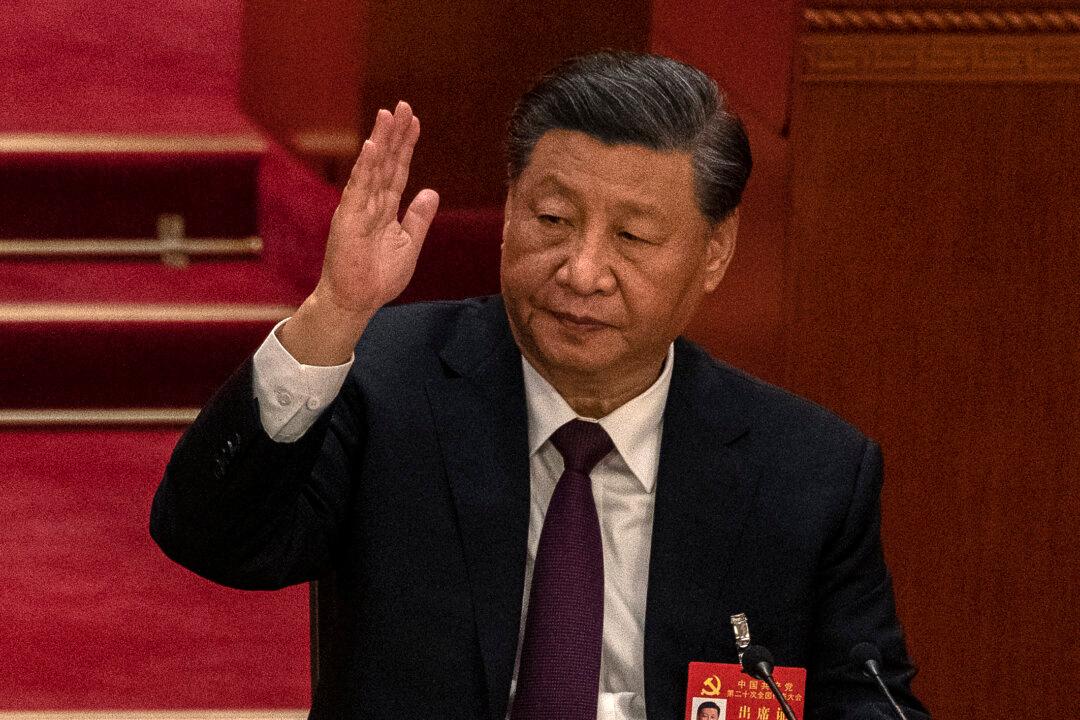

With Xi Jinping at the helm, it is unlikely China will recover economically or overtake the United States for several decades, if ever.

With Xi Jinping at the helm, it is unlikely China will recover economically or overtake the United States for several decades, if ever.