Commentary

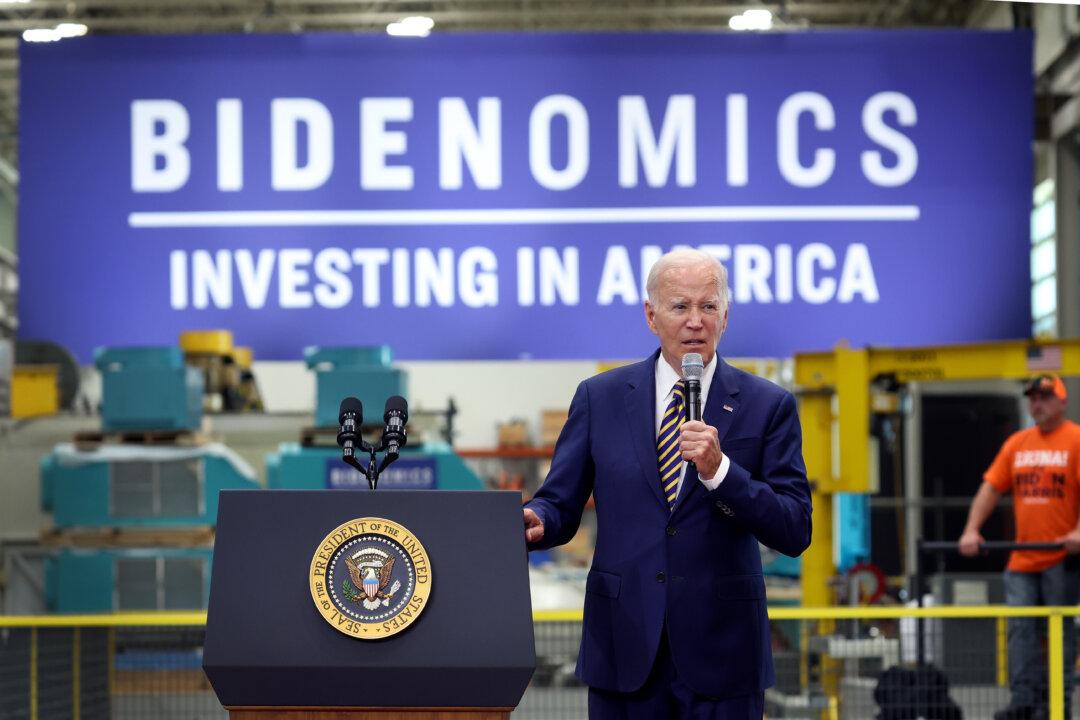

Just weeks before he was repudiated in a landslide in 1980, with inflation at nearly 13 percent, mortgage interest rates approaching 14 percent, and unemployment at 7.5 percent, President Jimmy Carter—likely the worst president of the 20th century—lectured an assemblage of reporters at the National Press Club about economic policy—and, remarkably, warned against practicing measures that resemble today’s “Bidenomics.”