“Globalization” is a popular term for what is happening to the economy, and it is often treated as if it were something utterly new. But only when considering trends over the past century can we describe globalization as relatively new, deepening in its importance since 1945.

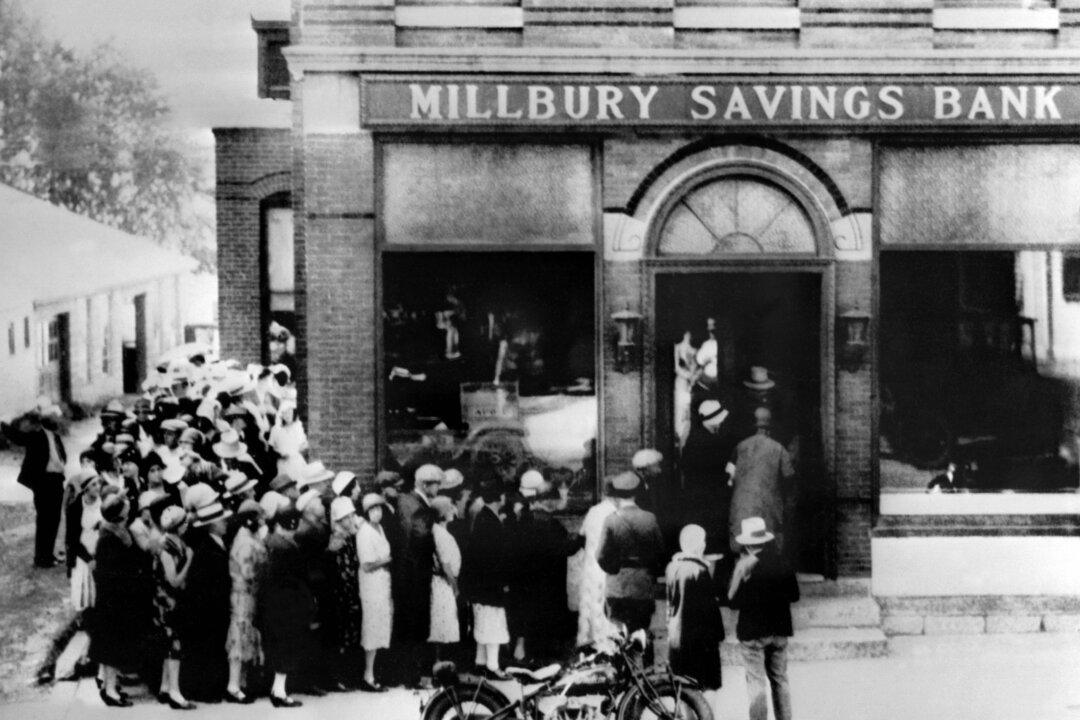

What we are experiencing now is not the first wave of globalization. The period from World War I through the Great Depression and World War II actually was just a break between the great century of globalization from 1815 to 1914 and the period after 1945. Many economists label this earlier period as the “first globalization.”