Commentary

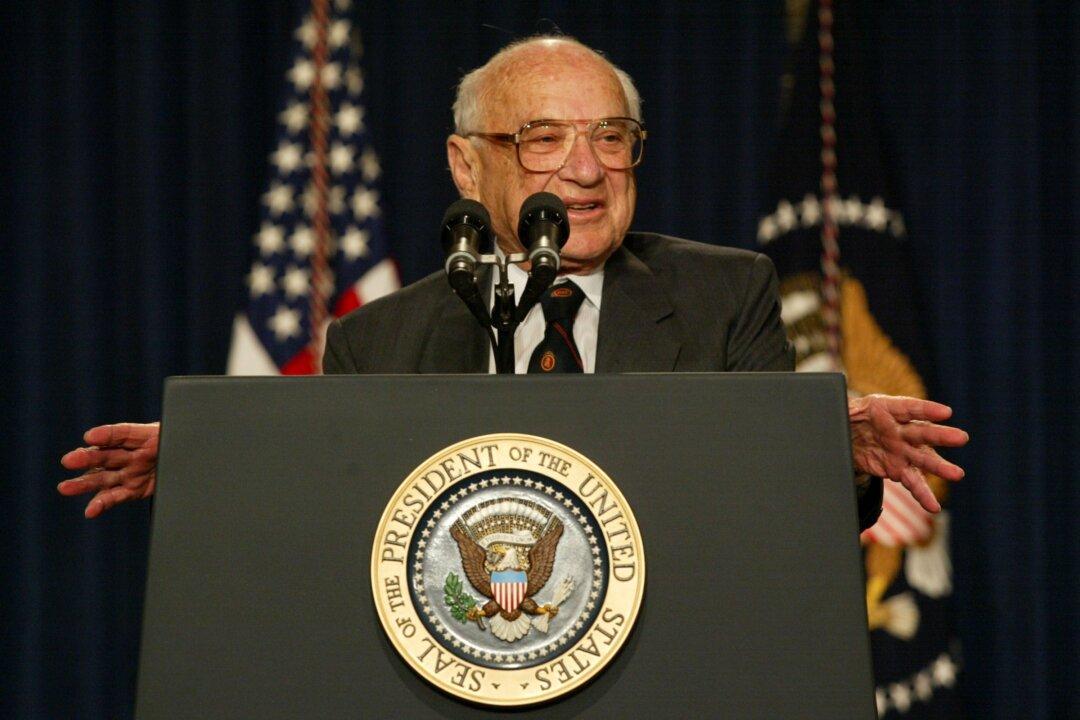

A friend’s mother was fond of saying there’s no good way to do a bad thing, and no bad time to do a good one. It’s true of public policy as of life generally, which is why both the public and politicians should talk more about principles and less about motives or tactics. And just as I was wrestling with applying this maxim to the current fiscal mess, someone Xed the classic Milton Friedman line to “Keep your eye on how much the Government is spending, because that is the true tax.”