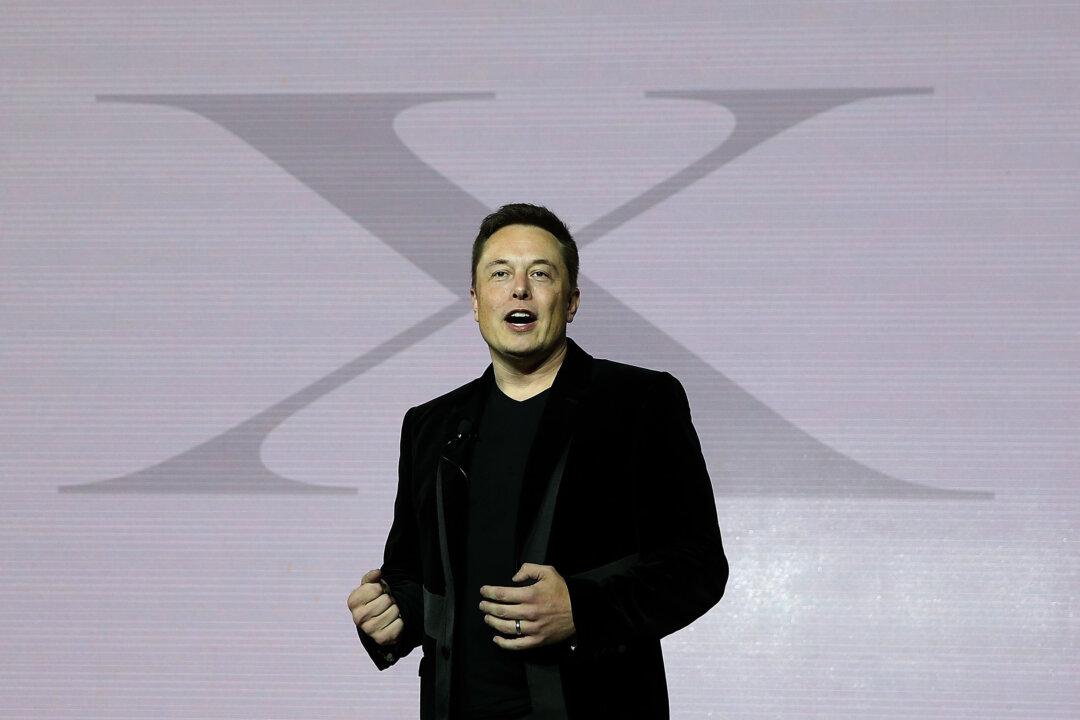

Great entrepreneurs polarize, and taking the degree of polarization as a yardstick, Tesla’s Elon Musk must be a great entrepreneur. Splitting the investor space and the public into two ironclad camps, he usually comes out on top of any detractors.

In May, Tesla’s stock dropped 30 percent from high to low after the old stories of delivery delays and tussle with analysts, but it has since rallied a whopping 50 percent. But the problems, especially the lack of profitability, remain.