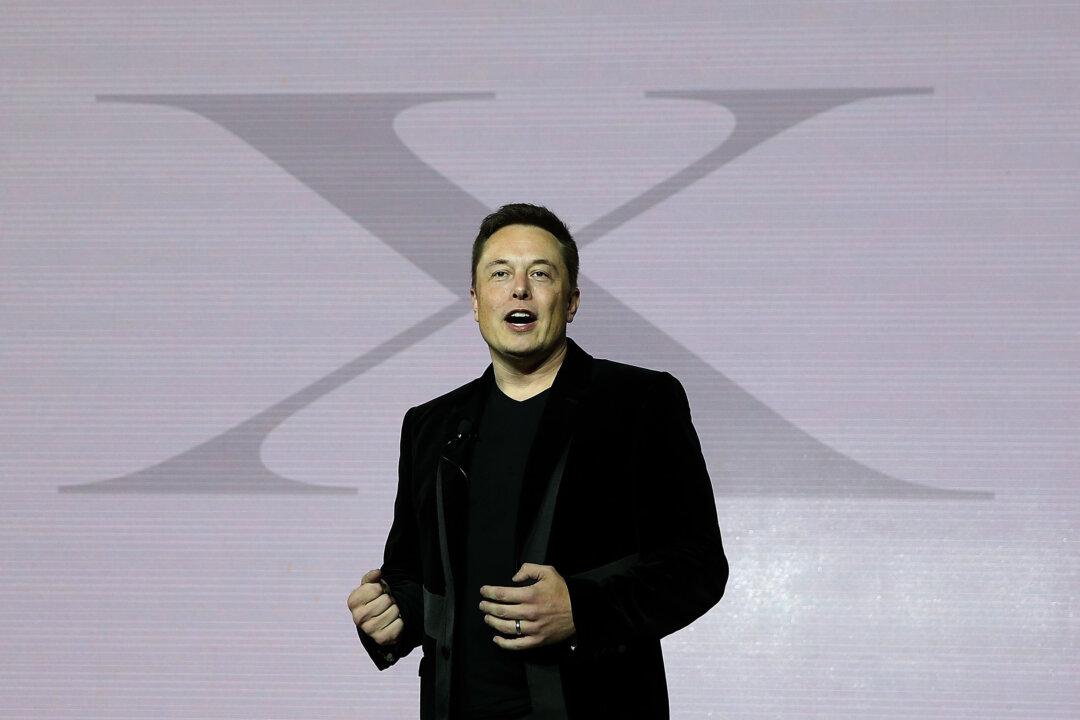

Elon Musk’s meltdown in the pages of The New York Times is a reminder that enterprises need both vision and operating smarts to be successful. It was obvious years ago that Musk needed help to build a new car company. Yet, somehow, the members of the board of directors did nothing as the Tesla CEO and co-founder led this extraordinary endeavor.

In my book “Ford Men: From Inspiration to Enterprise,” I noted that Henry Ford had the vision, but it was his partner James Couzens who actually turned the idea into a successful business. So bad was Ford’s reputation for tinkering and racing that he wasn’t even an officer of Ford Motor Co. when it was founded.