Commentary

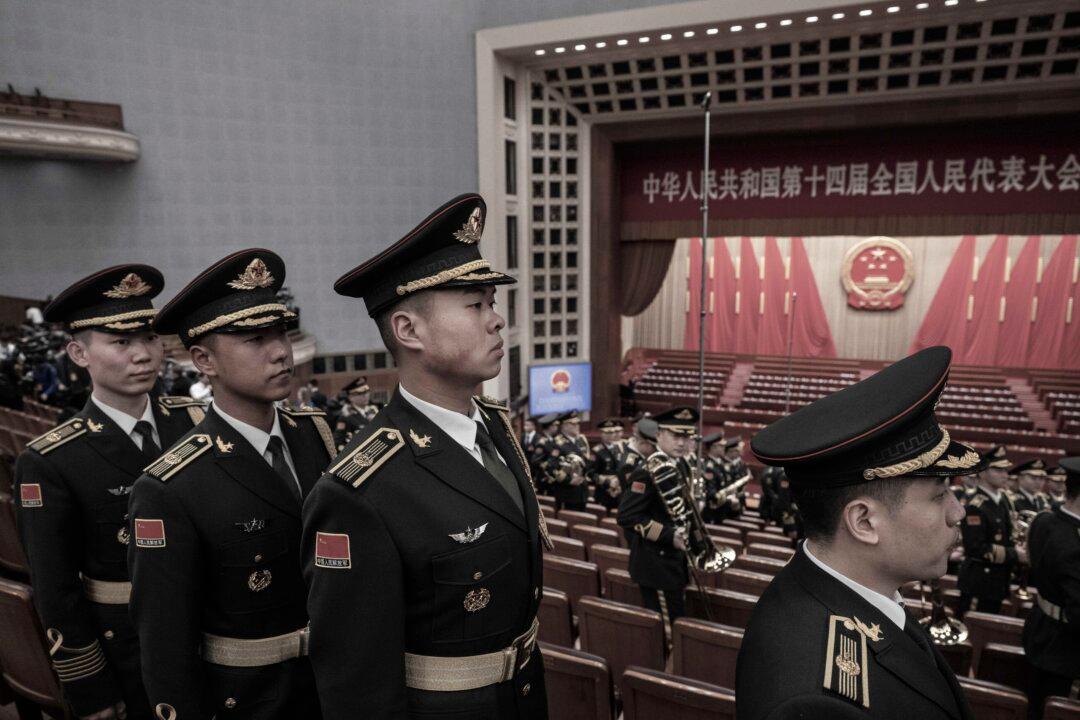

For years, the annual Two Sessions conference has informed anyone and everyone who matters in the Chinese Communist Party (CCP) where their leadership wants to go. This year’s meeting signaled little direction.

For years, the annual Two Sessions conference has informed anyone and everyone who matters in the Chinese Communist Party (CCP) where their leadership wants to go. This year’s meeting signaled little direction.