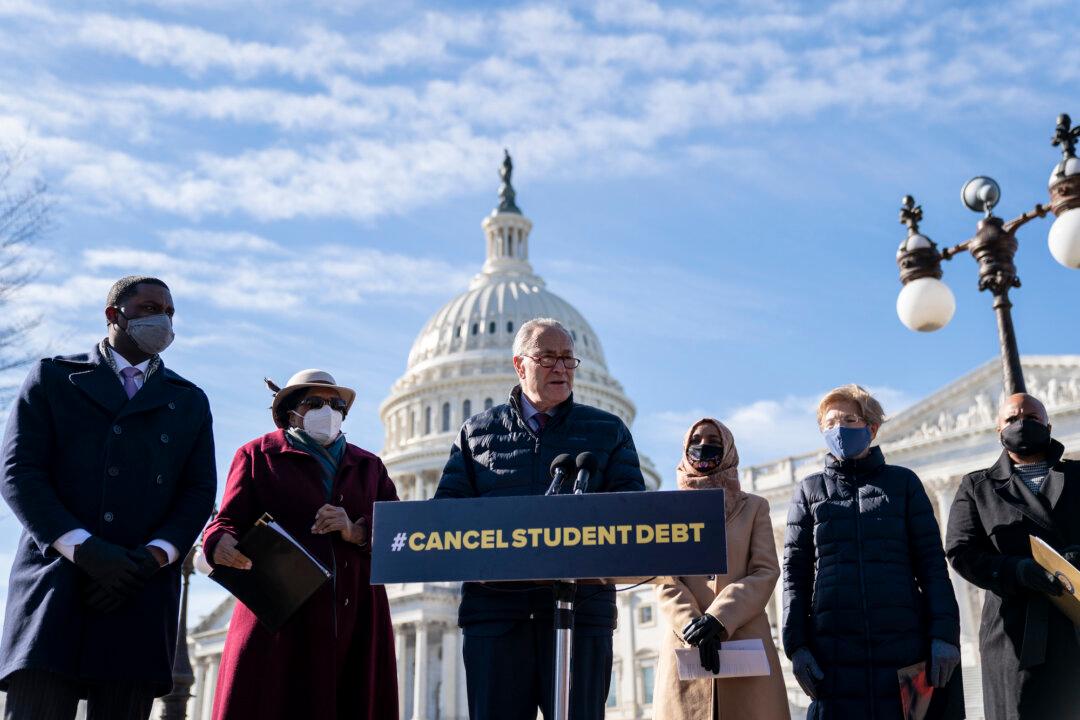

Progressive Democrat Sen. Elizabeth Warren (D-Mass.) has been leading the effort to have President Joe Biden use his existing authority to cancel $50,000 in student debt, but not all her Democrat colleagues are in agreement with the idea.

While many Senate Democrats agree with Biden canceling student loan debt, there are other senators who question how it is fair to the many who have paid off their debt already or ask how the federal government will pay for such a decision.