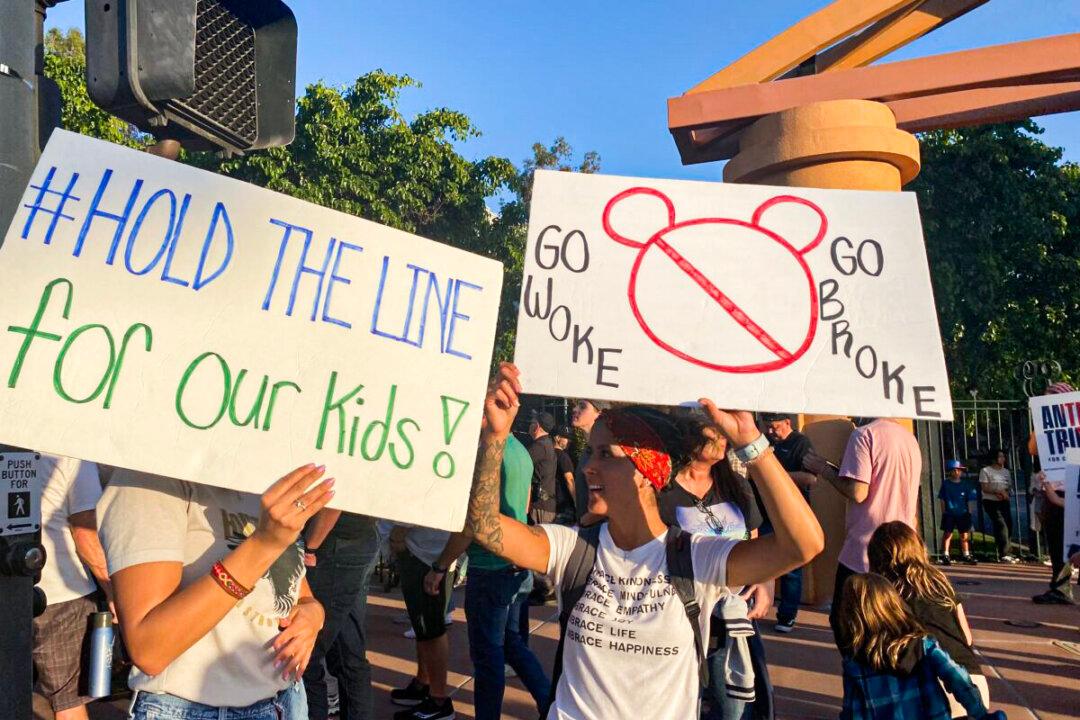

Disney’s active opposition to Florida’s Parental Rights in Education law resulted in the company’s stock pricing falling and a reduction in its market cap.

The stock’s decline will mostly impact the retirement savings of the working class, said Stephen Soukup, author of the book “The Dictatorship of Woke Capital: How Political Correctness Captured Big Business.”