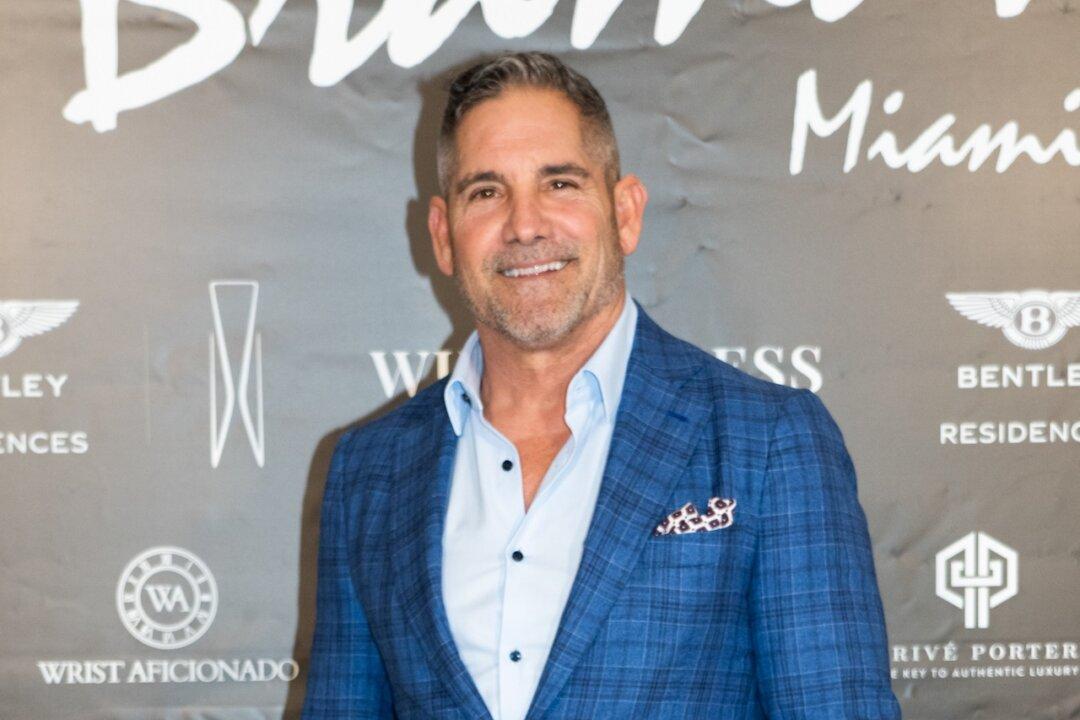

Renowned investor and bestselling author Grant Cardone said that the key to getting rich isn’t saving more—but rather putting your money to work effectively.

Cardone, whose net worth Forbes estimates at around $600 million, is a sought-after speaker on investment and personal finance, with over 7 million followers across platforms that include YouTube, Twitter, and Instagram.