Information About Chinese Firms Declared Off Limits

The implications for foreign investment could be significant if access to corporate files is severed.

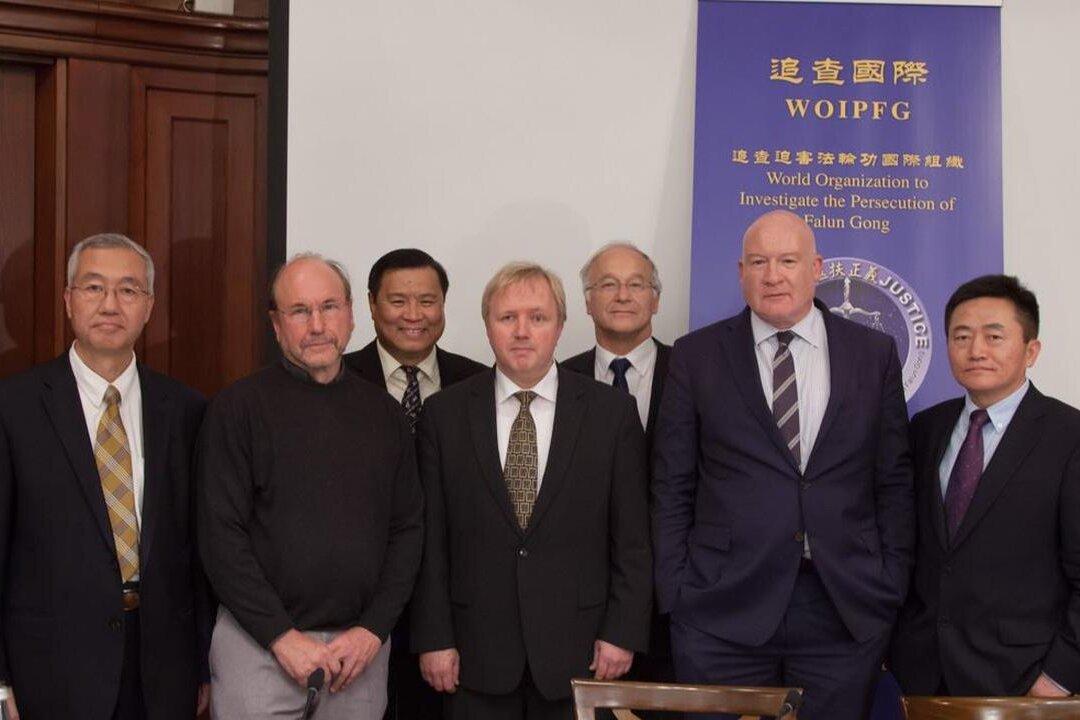

Dan David, vice president of GeoInvesting, speaks at a conference held in New York in May. Ariel Tian/The Epoch Times

|Updated:

Matthew Robertson is the former China news editor for The Epoch Times. He was previously a reporter for the newspaper in Washington, D.C. In 2013 he was awarded the Society of Professional Journalists’ Sigma Delta Chi award for coverage of the Chinese regime's forced organ harvesting of prisoners of conscience.

Author’s Selected Articles