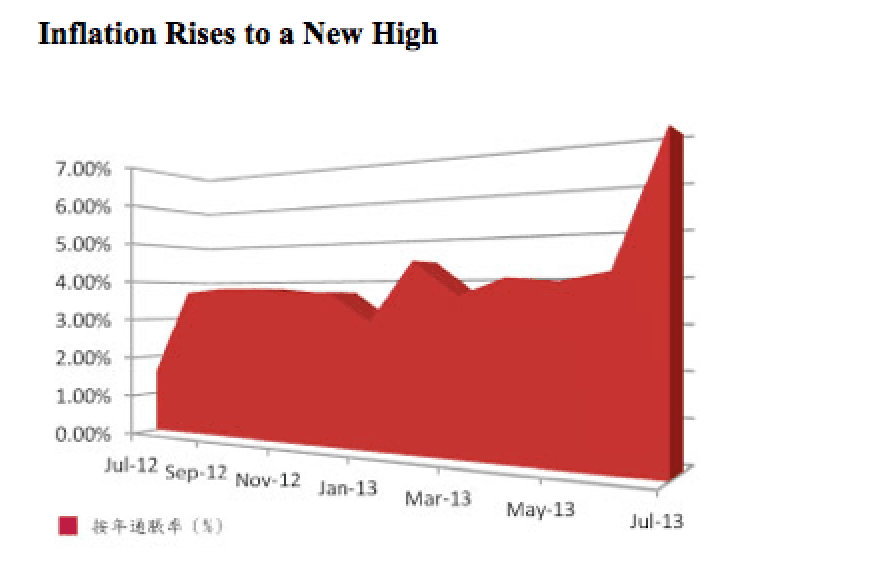

With property prices and the cost of renting an apartment continuing to increase, Hong Kong’s inflation has risen to the highest level in two years. The Hong Kong Statistics Department’s Aug 20 report indicates that the Consumer Price Index (CPI) in July rose 6.9 percent over the same month last year.

Overall expenditures, including housing and energy costs, have gone up in excess of 9 percent, dining out and grocery expenses increased by 4 percent, and transportation climbed by 2.7 percent. Many citizens complain that salary increases are not keeping up with inflation.

There was significant growth in July in the annual Composite CPI, but this was mainly due to a low comparison reference, resulting from the government’s public housing subsidies in July of last year. Taking into account the government’s one-time relief measures, the Composite CPI increased 4.2 percent, which was higher than June’s 4 percent, but still primarily the result of a rise in private housing, rentals, and travel expenses.

CPI (A), (B), (C) increased within 5 percent

CPI in Hong Kong is measured by three indices: (A), (B), and (C). (A) is based on the expenditure

patterns of about 50 percent of households in Hong Kong, which have an average monthly expenditure of $4,500-$18,499 during the survey period of the 2009/10 Household Expenditure Survey. (B) is based on the expenditure patterns of the next 30 percent of households, which have an average monthly expenditure of $18,500-$32,499 in the same period. (C) covers the further next 10 percent of households with an average monthly expenditure of $32,500-$65,999 in the period.

Taking into account the Hong Kong Government’s one-time relief measures, the annual growth rate of CPI (A), (B), and (C) Indices were, respectively, 4.8 percent, 4.0 percent, 3.9 percent in July and 4.55 percent, 3.8 percent, 3.6 percent in June. The aggregated first seven month Composite CPI (A), (B) and (C) Indices increased 3.9 percent, 4.4 percent and 3.5 percent compared with the last year.

For various consumer items, the order of cost recorded in the annual growth rate for July 2013 were housing [which increased by 15.1 percent in the Composite CPI and 32.4 percent in CPI (A) mainly because of the low comparison reference], electricity, gas, and water (which rose by 9.3 percent and 9.8 percent), dining out, miscellaneous services, grocery, transportation, miscellaneous goods, alcohol/tobacco, and clothing/footwear increased by 4.4 percent, 3.9 percent, 3.6 percent, 2.7 percent, 2.3 percent, 2.2 percent and 1.6 percent respectively.

Private housing costs and future inflation predictions.

According to a government spokesperson, basic consumer price inflation climbed slightly because of the increase in private housing rentals and travel expenses, and was expected to continue to climb in the coming months.