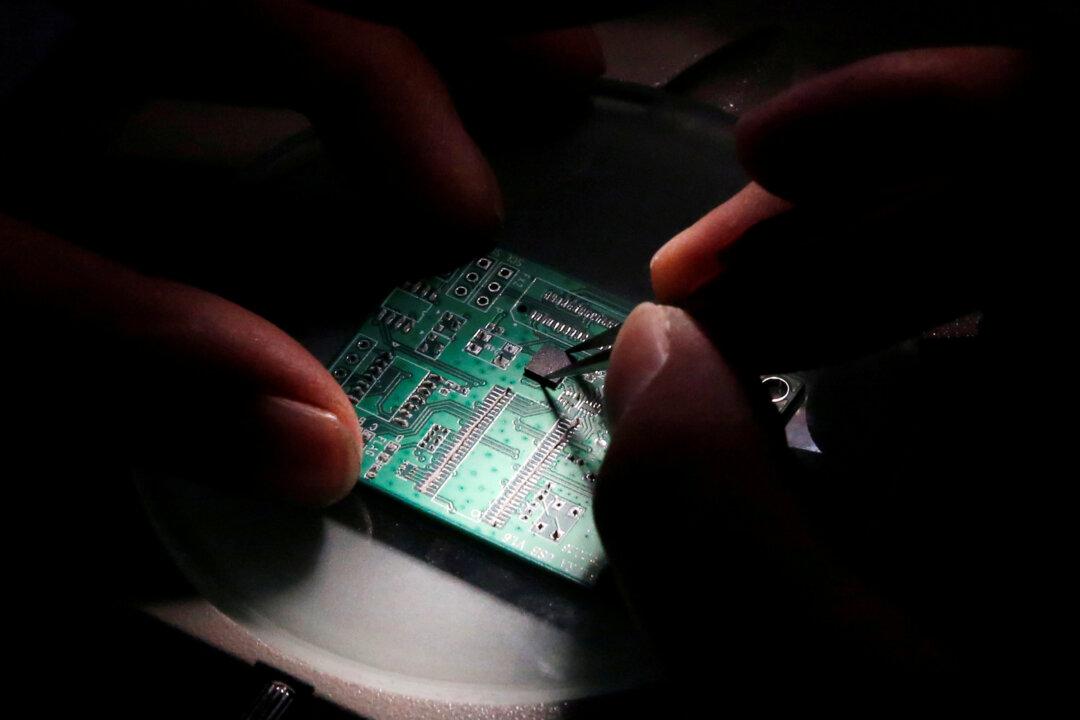

Recently, Japan and the Netherlands agreed to join the United States in restricting semiconductor manufacturing equipment to China. Together the three countries account for 90 percent of the global semiconductor equipment market. The union is expected to hand a blow to the Chinese chip industry.

Japan and the Netherlands stated that the new restrictions are for national security. Following the news of the export restrictions, the CCP’s mouthpiece Global Times reported that China is now building chip manufacturing plants at a rate of 100 production lines per year, but that under the U.S. sanctions, the construction of these plants could be delayed or shelved. The report suggests that Chinese manufacturers must expect the worst at this stage.