In the last month, California’s gas prices averaged $4.03 per gallon, $1.18 more than the national average. It comes as California’s gasoline taxes are set to increase by an additional 5.6 cents per gallon on July 1. Current California and federal gasoline taxes stand at 55.5 cents and 18.4 cents respectively as of January, totaling to 73.9 cents per gallon. How is this affecting the average Californian?

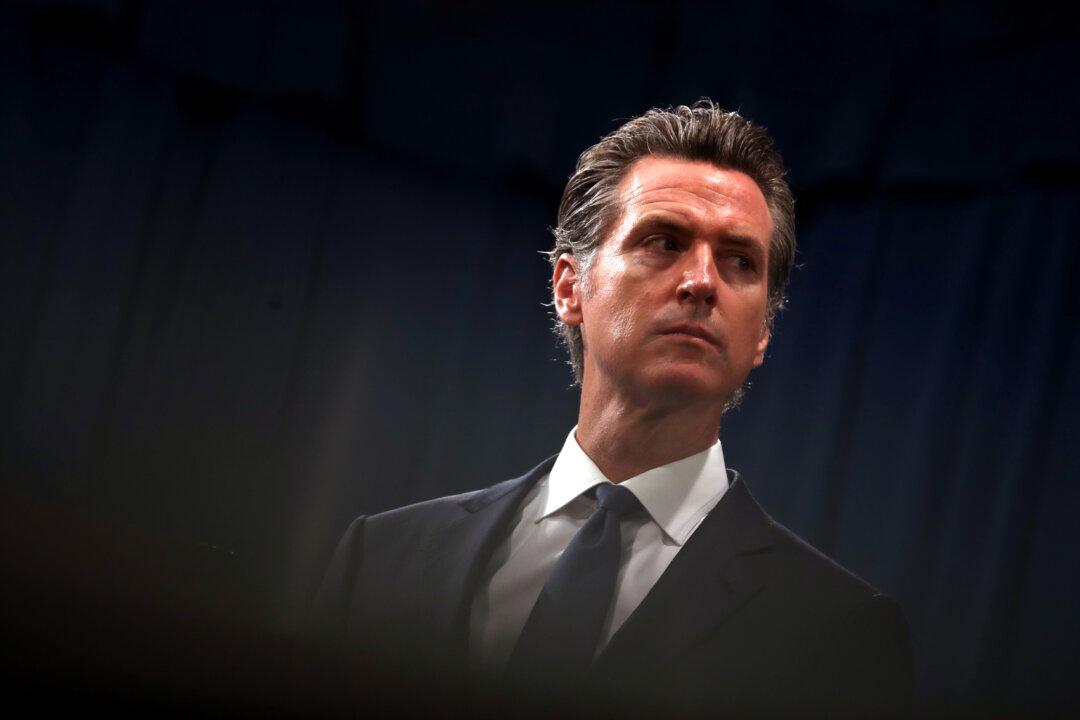

The state government has decided to look into the issue. On April 23, California Gov. Gavin Newsom asked the California Energy Commission for an analysis on the state’s gas prices by May 15.