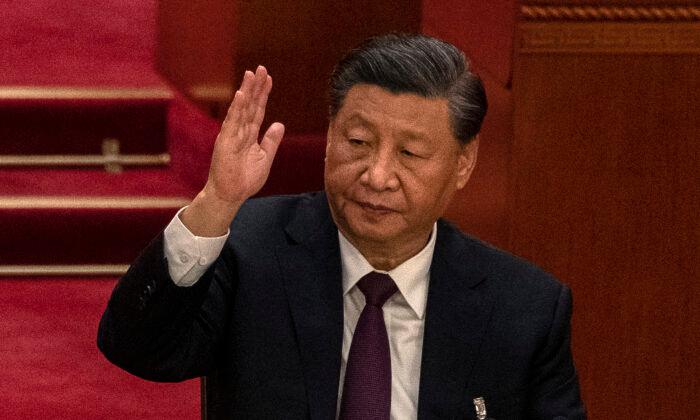

Stocks at the Hong Kong exchange suffered one of their worst days in a long time after the National People’s Congress of China confirmed Xi Jinping for a historic third five-year term as the party leader.

Hong Kong’s Hang Seng Index fell by 6.3 percent on Monday, to its lowest level since April 2009. The Hang Seng Tech Index plunged by more than 9 percent. The Hang Seng China Enterprises Index, a gauge of Chinese stocks that are listed in Hong Kong, declined 7.3 percent, which is its worst performance after a Chines Communist Party Congress since 1994. This was the worst day for stocks in Hong Kong since the global financial crisis of 2008–09, while the onshore yuan fell to its weakest level since January 2008.

The party meeting was mostly about personnel changes rather than focusing on the economy. Xi has stacked the party’s core leadership group with those loyal to him.

Strong supporters of zero-COVID policies have been appointed to the Politburo Standing Committee, thus minimizing any chances that the country might ease pandemic restrictions. Investors are also worried that Beijing’s sweeping crackdown on private firms, which began in 2020, would continue.

“The market is concerned that with so many Xi supporters elected, Xi’s unfettered ability to enact policies that are not market-friendly is now cemented,” said Justin Tang, head of Asian research at United First Partners, according to the media outlet.

Chinese Economy

China released a set of economic figures on Monday, showing a gross domestic product (GDP) growth of 3.9 percent in the three months between July and September when compared to the same period last year.Though the number exceeded market estimates, it is still far off from the high rate of growth the nation had seen during the previous decades. China has set a growth target of 5.5 percent for 2022.

The country is also facing numerous economic challenges. The crackdown on the private sector has hit the job market hard. The unemployment rate stood at an elevated 18.7 percent in August.

China’s real estate sector, which accounts for around 30 percent of the GDP, has been in trouble for some time. Thousands of homebuyers have refused to make their mortgages on stalled projects.

But now the situation has changed. “This model had reached a point of significantly diminishing returns and was increasing economic inequality, financial debt, and environmental damage,” Thomas said.