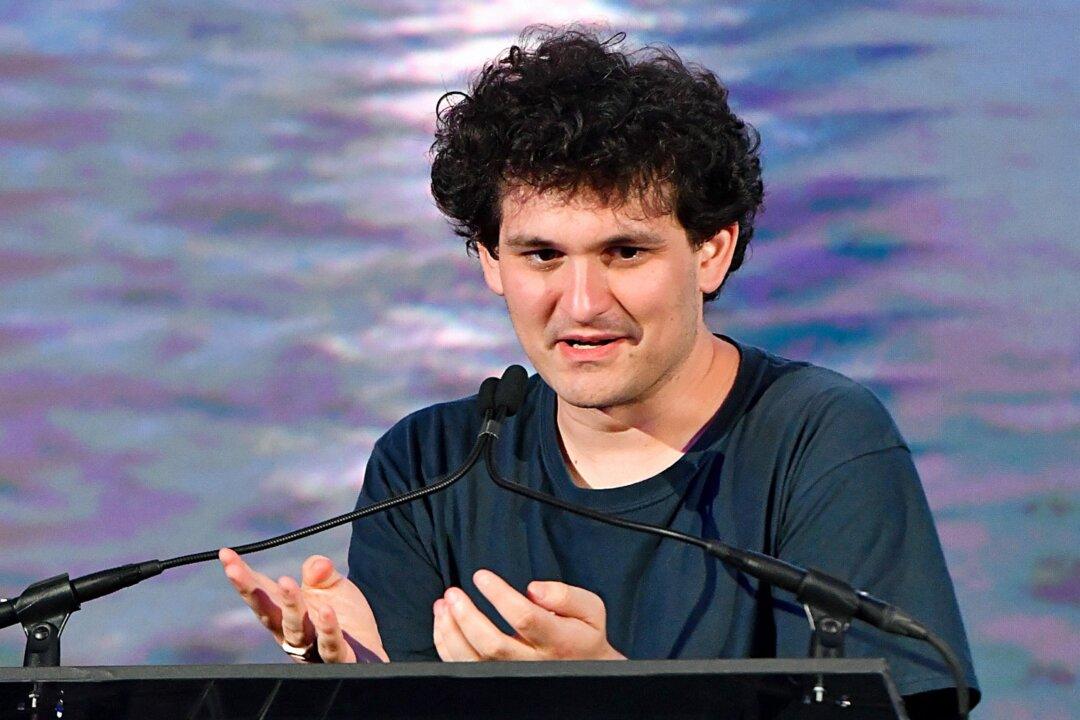

FTX founder Sam Bankman-Fried noted on Twitter on Nov. 23 that he will speak at a New York Times summit this week.

“I’ll be speaking with @andrewrsorkin at the @dealbook summit next Wednesday (11/30),” Bankman-Fried posted on Twitter.

FTX founder Sam Bankman-Fried noted on Twitter on Nov. 23 that he will speak at a New York Times summit this week.