Focus

European economy

LATEST

Deflation Looms as Europe’s Economic Bugbear

It’s the D-word that’s pushing the European Central Bank into a corner.

|

European Car Sales Slide in September

European car sales crashed in September as data from an industry association shows. German new car registrations fell 11 percent to 250,000 vehicles compared to August. Declines in France and Italy surpassed 20 percent.

|

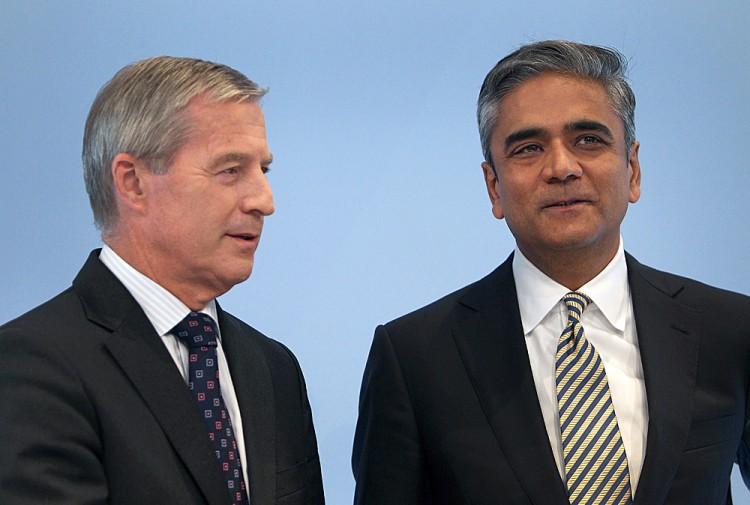

Deutsche Bank Announces Strategy 2015+

Deutsche Bank AG’s new corporate Strategy 2015+ includes a reduction in profitability targets, ambitious cost-cutting and restructuring plans.

|

Greek Exit Scenarios Gaining Traction

European stock markets pulled back last week as the EURO STOXX benchmark index lost 1.5 percent but the euro currency gained 1.5 percent to 1.2516.

|

European Market Insight: ECB President Draghi Prompts Rollercoaster Ride

It has previously been noted that markets respond especially well to central banks as politicians have mostly lost all their credibility, and last week provided another example of how policymakers can influence financial markets.

|

European Market Insight: Game of Chicken Leads to Spanish Bailout in the End

Last week was volatile, frantic, and nerve-racking for traders and investors alike. So called “tape-bombs”—a term used by traders to describe market moving news items—hit right and left.

|

G-7 Finance Ministers Meet as Euro Crisis Deepens

The finance ministers of the Group of Seven (G-7) nations met the morning of June 5 to discuss and review options that eurozone leaders have proposed to move forward on to create a stronger fiscal and political union.

|

EU Markets Tumble on Absence of Strong Policy Response

Last week, European financial markets tumbled on concerns over Spanish banks and the ongoing European sovereign debt crisis.

|

Outlook for Europe Negative

Investment gurus and economic advisors are becoming more negative when the topics of the European Union (EU) and the Euro are discussed.

|

European Market Insight: European Markets Post Small Gains Amid French Election Jitters

Last week saw markets recover a bit after the previous week’s rout, but the situation remains precarious and volatile in the Eurozone.

|

EUROPEAN MARKET INSIGHT: Greek Decision on Private Sector Involvement Triggers CDS

The European economy remains squarely in the doldrums.

|

European Market Insight: Euro Currency and Shares Looking Up

Economic data in Europe was mixed at best, but markets were lifted on positive economic data.

|

European Market Insight: Bad Economic Data, Auctions, and Tensions Lead Euro Lower

Last week, European markets saw a slew of economic data releases as well as bond auctions and several sovereign themes coming to the fore amid rising trading volumes.

|

European Market Insight: Last Trading Week a Reflection of Volatile 2011

Trading was volatile for most of last week in light volume. There was no economic data release worth mentioning but an Italian bond auction managed to upset the markets temporarily.

|

European Market Insight: All Eyes on Central Bank Financing Operations

Economic data did not rock European financial markets last week as the focus was on the first round of 36-month European Central Bank (ECB) refinancing operations.

|

European Market Insight: Global Central Bank Intervention Sends Markets Soaring

Last week’s positive trend was essentially carried by the announcement of the six most important central banks of the world—the Federal Reserve, the European Central Bank (ECB), Bank of Japan, Swiss National Bank, Bank of England, and the Bank of Canada—providing liquidity to mostly European banks in a global effort.

|

Deflation Looms as Europe’s Economic Bugbear

It’s the D-word that’s pushing the European Central Bank into a corner.

|

European Car Sales Slide in September

European car sales crashed in September as data from an industry association shows. German new car registrations fell 11 percent to 250,000 vehicles compared to August. Declines in France and Italy surpassed 20 percent.

|

Deutsche Bank Announces Strategy 2015+

Deutsche Bank AG’s new corporate Strategy 2015+ includes a reduction in profitability targets, ambitious cost-cutting and restructuring plans.

|

Greek Exit Scenarios Gaining Traction

European stock markets pulled back last week as the EURO STOXX benchmark index lost 1.5 percent but the euro currency gained 1.5 percent to 1.2516.

|

European Market Insight: ECB President Draghi Prompts Rollercoaster Ride

It has previously been noted that markets respond especially well to central banks as politicians have mostly lost all their credibility, and last week provided another example of how policymakers can influence financial markets.

|

European Market Insight: Game of Chicken Leads to Spanish Bailout in the End

Last week was volatile, frantic, and nerve-racking for traders and investors alike. So called “tape-bombs”—a term used by traders to describe market moving news items—hit right and left.

|

G-7 Finance Ministers Meet as Euro Crisis Deepens

The finance ministers of the Group of Seven (G-7) nations met the morning of June 5 to discuss and review options that eurozone leaders have proposed to move forward on to create a stronger fiscal and political union.

|

EU Markets Tumble on Absence of Strong Policy Response

Last week, European financial markets tumbled on concerns over Spanish banks and the ongoing European sovereign debt crisis.

|

Outlook for Europe Negative

Investment gurus and economic advisors are becoming more negative when the topics of the European Union (EU) and the Euro are discussed.

|

European Market Insight: European Markets Post Small Gains Amid French Election Jitters

Last week saw markets recover a bit after the previous week’s rout, but the situation remains precarious and volatile in the Eurozone.

|

EUROPEAN MARKET INSIGHT: Greek Decision on Private Sector Involvement Triggers CDS

The European economy remains squarely in the doldrums.

|

European Market Insight: Euro Currency and Shares Looking Up

Economic data in Europe was mixed at best, but markets were lifted on positive economic data.

|

European Market Insight: Bad Economic Data, Auctions, and Tensions Lead Euro Lower

Last week, European markets saw a slew of economic data releases as well as bond auctions and several sovereign themes coming to the fore amid rising trading volumes.

|

European Market Insight: Last Trading Week a Reflection of Volatile 2011

Trading was volatile for most of last week in light volume. There was no economic data release worth mentioning but an Italian bond auction managed to upset the markets temporarily.

|

European Market Insight: All Eyes on Central Bank Financing Operations

Economic data did not rock European financial markets last week as the focus was on the first round of 36-month European Central Bank (ECB) refinancing operations.

|

European Market Insight: Global Central Bank Intervention Sends Markets Soaring

Last week’s positive trend was essentially carried by the announcement of the six most important central banks of the world—the Federal Reserve, the European Central Bank (ECB), Bank of Japan, Swiss National Bank, Bank of England, and the Bank of Canada—providing liquidity to mostly European banks in a global effort.

|