Deutsche Bank AG’s new corporate Strategy 2015+ includes a reduction in profitability targets, ambitious cost-cutting and restructuring plans. It emphasizes a shift in culture to boost “sustainable performance” the bank said at a press conference Tuesday in Frankfurt.

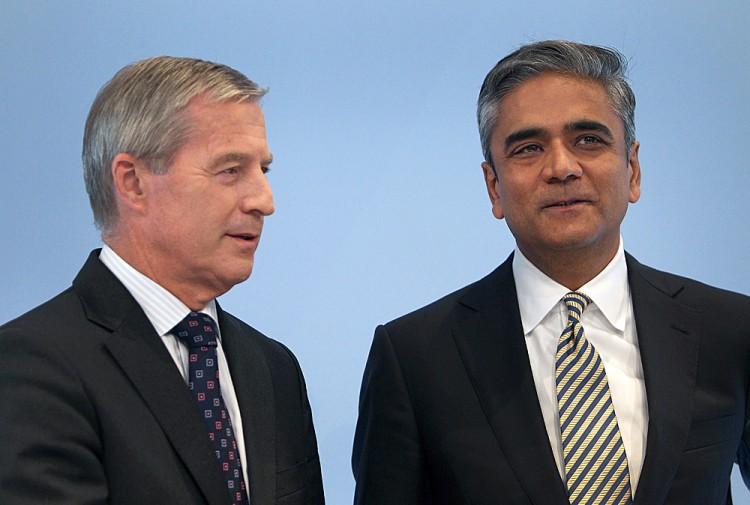

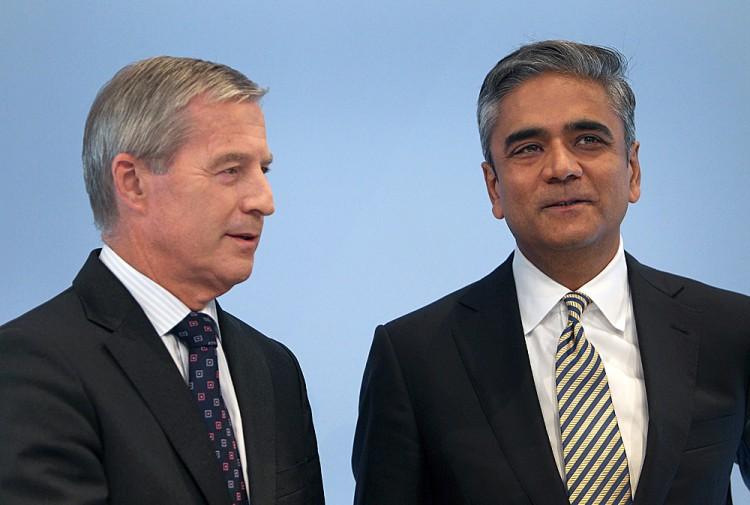

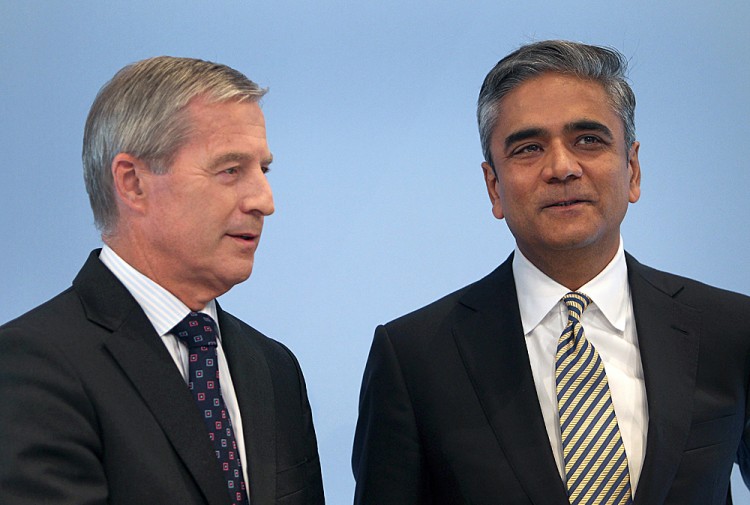

“Deutsche Bank aims to emerge as a long-term winner from the fundamental shifts taking place in the banking industry,” said Jürgen Fitschen, one of the two co-chairmen of the Deutsche Bank executive board at the press conference. Fitschen together with Anshu Jain took over the reins from Josef Ackermann on May 31.

While assuming revenue growth in line with the industry, Deutsche bank plans to “significantly improve … operating performance and efficiency” in order to achieve an after-tax return for shareholders of 12 percent. During the Ackermann era, the bank aimed for a pretax return of 25 percent, whereas the new target corresponds to only 17–18 percent before taxes, largely due to a “challenging” regulatory and economic outlook.

Employee Compensation At Heart of Culture Shift

According to the press release, the bank will reduce and restructure employee compensation—especially to top management—in order to achieve a shift in culture and create a more sustainable business environment. The new plan will “reduce bonus payments in relation to business performance and will increase the time horizon for deferred bonus payouts.”

Previously employees could cash in part of their deferred share compensation over three years, now they will only be able to sell their shares in one transaction after five years. Should they decide to leave the firm voluntarily, the shares will not be paid out. In case of a redundancy, they would be paid out, provided the employee did not commit any wrongdoing.

A senior executive in Frankfurt who talked to The Epoch Times on request of anonymity said: “I think there has to be a cultural change in the financial industry. We all know that we should not reward quick short-term profits but rather long-term creation of value. It has to be mix between shareholder value and competitive compensation in order to retain the best talent at Deutsche Bank.”

Deutsche Bank plans to cut costs by 4.5 billion euros ($5.78 billion) per year until 2015, mainly by cutting costs and reducing bonus payments. According to the German magazine Der Spiegel, 1,900 jobs will be shed in the process. In 2011, the bank made a net profit of 5.35 billion euros ($6.88 billion).

No Capital Raising Necessary

The piece of news that propelled the shares upward 4.10 percent in German trading today was more related to the fact that the bank said it would boost capital without raising new equity. The bank, which according to many analysts has comparatively little regulatory capital when compared to peers, plans to increase the key metric Tier 1 ratio to 10 percent in 2015.

Morgan Stanley analysts are skeptical, as they write in their most recent report: “We currently forecast DB reaches [a Tier 1] of 7.3% [by the end of 2012]”, while the peer average is in the range of 8–10 percent. “DB says it can achieve 8% by [2013] but we think potential litigation and restructuring charges … could be a drag.”

The Epoch Times publishes in 35 countries and in 19 languages. Subscribe to our e-newsletter.