Five individuals were sentenced to prison last week after they were implicated in a $1 billion biofuel tax fraud scheme.

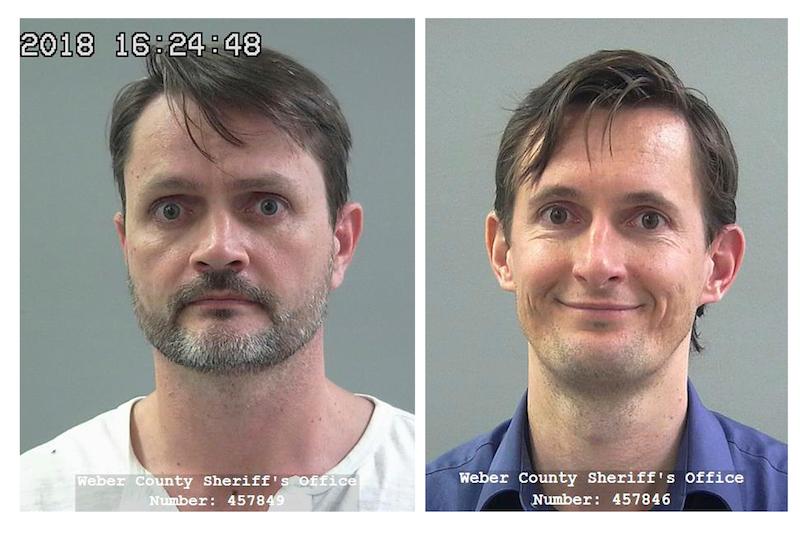

Lev Aslan Dermen (56), a.k.a. Levon Termendzhyan, a Los Angeles businessman, received 40 years in prison; Jacob Kingston (46) was sentenced to 18 years; Isaiah Kingston (42) was sentenced to 12 years; Rachel Kingston (67) was sentenced to seven years; and Sally Kingston (45) was sentenced to six years, according to a Department of Justice press release.