Sponsored

Can you really trust your medical bills?

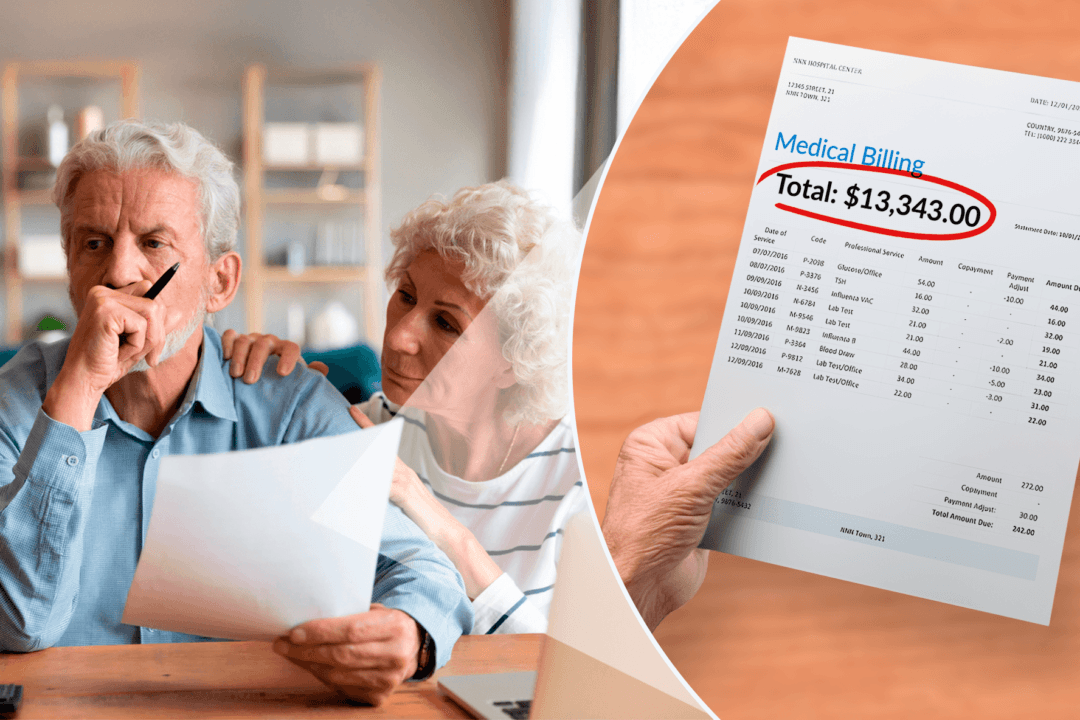

We all want to think that we’re not being overcharged for our medical services but that is oftentimes not the case.

Recent statistics reveal that more than 40 percent of people think that their medical bills contain an error. These errors cost consumers over $100 billion every year!

Whether it’s the hospital, the doctor’s office, the pharmacy or anywhere in between, chances are good that some of this wasted spending has come out of your pocket, too.

When you consider our chaotic, confusing medical system, it makes sense. Medical staff are human, too—they make mistakes, especially when it comes to billing. Add in the fact that they are overworked, constantly exhausted, and underpaid, and it’s no wonder our medical system is facing a crisis of mistakes, false billing, and fraud.

Not only were millions of Americans overcharged, more than 133 million health care records were breached in 2023 alone!

When people are forced to choose between putting food on the table or getting medical care, something is clearly broken. Our health care billing system isn’t just confusing—it’s disorganized and insecure, which causes incredible pain for its victims.

Worst of all, it’s unbelievably common! Stories of someone being overbilled or having their insurance claim wrongfully denied dominate news coverage. You could be overpaying for medical care right now. How would you know?

The damage could be a few overlooked dollars—or life-changing theft that takes months or years to fix. Thankfully, there is an easy way to get help—but before we get to that—let’s first examine why this problem even exists in the first place.

Why Do Medical Billing Errors Happen?

When it comes to medical billing errors, most are due to:- Upcoding: This is when you’re charged for a more expensive service or medicine than you actually received. For example, they may charge you for a brand name product, but provide generics or—in the worst cases—nothing at all.

- Coding Errors: This is when the wrong billing code is applied, resulting in you being charged for different products or services than you actually received.

- Duplicate billing: Being charged multiple times for the same thing. This is hard to catch unless you carefully review every bill you receive.

That’s not all, of course. Medical records are extremely valuable, and shockingly easy to steal. This is the worst case scenario, and yet it’s becoming increasingly common.

Medical records are often sold on the dark web because they include all your sensitive information—Social Security numbers, addresses, and birth dates. This can be used to open credit accounts, secure loans, or commit tax fraud in your name.

How Can You Avoid Being a Victim of Medical Billing Errors and Fraud?

In our chaotic system, medical billing errors are on the rise, and they’re rarely caught. Unless you want to study every bill, filled with confusing jargon, then you’re likely to overpay at least once in your life—if not more often.Until recently, the only way to stop medical billing errors was to catch the errors yourself, then spend months or even years fighting the system yourself, with little hope of success. And there was no real way to keep yourself protected from medical identity theft at all!

However, that has all changed thanks to HealthLock—a service designed to protect Americans from the expensive, potentially life-changing mistakes and fraud that are flooding our chaotic medical system.

HealthLock has existed as a private service for high-net-worth individuals for over a decade. After optimizing their technology, they recently opened their doors to the public—and now Americans across the country can finally take advantage of the advanced protection and peace of mind they offer.

What Is HealthLock?

HealthLock is a service that helps you avoid overpaying on medical bills, stop medical identity theft, and recover money you’ve already lost.

It’s backed by powerful analytics-driven technology and a team of ever-vigilant professionals who work around the clock to protect your privacy, help stop unnecessary losses, and give you and your family peace of mind in our chaotic medical system.

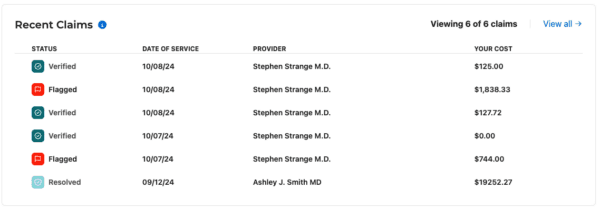

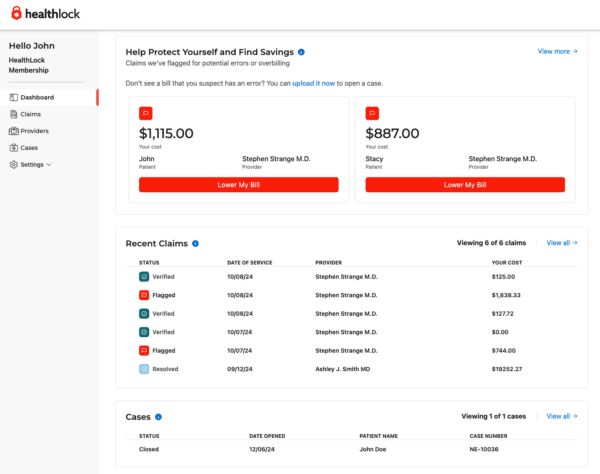

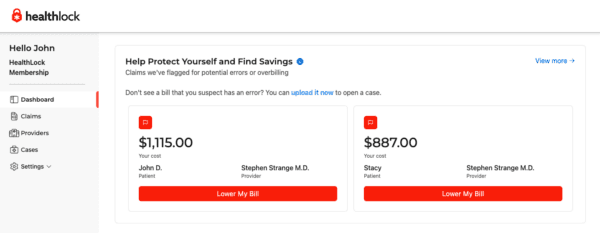

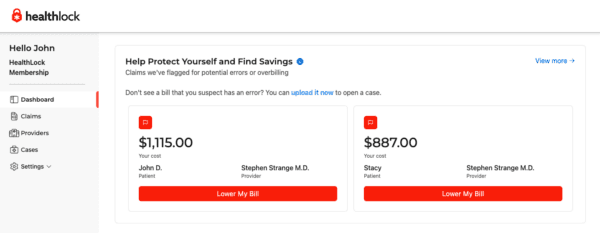

In short, HealthLock connects with your insurance, then it automatically reviews your claims for billing errors, fraud, and suspicious activity. All of your claims are organized into a single easy-to-use dashboard, giving you a clear overview of everything.

Despite recently opening to the public, HealthLock has become a huge success. The service has quickly grown, and now they offer nationwide coverage and sync with 250+ insurance providers.

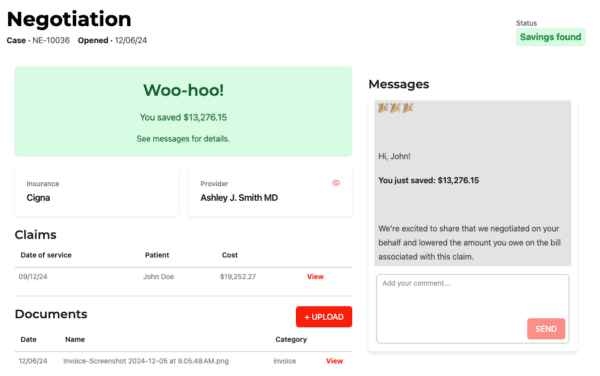

HealthLock now protects 100,000 people and has reviewed more than $500 million in bills. In that time, they’ve saved over $130 million for their customers, and their negotiators have helped members save an average of 23 percent on their bills.

What Does HealthLock Do?

HealthLock helps you fight back against the chaos in our medical system. It’s designed to give you peace of mind about your medical billing and private information, and it’s been highly successful so far.Here are just a few of the reasons why so many people are signing up for HealthLock:

Automatic Claim Analysis:

HealthLock syncs with your insurance providers to automatically audit medical claims, helping to identify overbilling and errors before they impact you. You also get peace of mind knowing they’ll verify that all your claims are correct so you don’t have to guess.This means that they catch bills before you have to pay them, which can save you hours of headache and hundreds to thousands of dollars!

Bill Negotiation & Fighting Denials:

Not only does HealthLock give you peace of mind that your medical claims are secure, they can even help you reclaim your money if a mistake gets through—or help you fight back against a denied medical claim. After all, discovering the mistake is the easy part—recovering your money is difficult, time-consuming, and stressful!Thankfully, HealthLock are the experts, and they have an incredible success rate. It’s like having your own private accountant carefully poring over every bill so you don’t have to—who then becomes a lawyer to fight back with a proven process that works.

Privacy Protection:

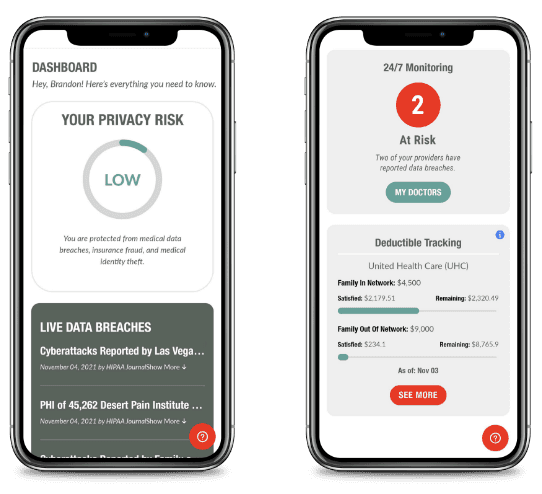

HealthLock monitors health care providers for breaches and alerts you if they detect your provider has suffered a data breach, placing your private information at risk. You can relax knowing someone is always watching out for your personal medical data.

Fraud Remediation:

HealthLock even offers support in remediating fraudulent charges and restoring your medical identity when necessary.Easy Dashboard:

Not only does HealthLock keep you protected, it’s also extremely helpful at keeping everything organized. Now you can finally secure all your medical claims and bills—for you and your family—in one easy place!It doesn’t matter if everyone in your extended family all has separate insurance, including dental and vision. HealthLock can combine it into one simple dashboard!

HealthLock Has Already Saved $130,000,000+

There are countless stories of people who HealthLock has helped save money and time. For example:He had already paid his full deductible for the year—but they billed him anyway. HealthLock flagged it, and Gary didn’t have to pay a single cent out of pocket.

HealthLock notified him of the mistake, then submitted an appeal and helped him save $4,892.36.

At the office, she asked the receptionist if they took insurance, and she said yes. But when she got the bill, it was for the full amount! HealthLock negotiated for Kathy, resulting in the bill being taken care of and saving her $1,364.44.

These are just a small handful of the stories pouring in from HealthLock users. These mistakes are sadly all too common — but thankfully, HealthLock’s advanced technology and professional team are highly successful at spotting and fixing them before they can wreak havoc on your life.

How To Sign Up For HealthLock

Joining HealthLock is easy for everyone—whether you’re signing up for yourself or your entire family.1. Visit the official HealthLock website

2. Answer a few questions about yourself

HealthLock will make sure you’re eligible for the service. They work with virtually every insurance provider, so your chances are very good!

3. Connect your insurance and enjoy peace of mind!

Within 72 hours, HealthLock will organize your claims, perform a 2-year look back, and begin 24/7 monitoring.

You may discover that you’ve already been overcharged, and HealthLock can even help you recover those funds. HealthLock automatically flags errors in the past 90 days, along with performing a 2-year look back, which may spot further opportunities to negotiate for money back. Additionally, you’ll be alerted if HealthLock detects billing errors, fraud, or suspicious activity.Have You Already Been Overcharged? Find Out in Minutes—And Start Recovering Your Lost Money!

Best of all, you could get a surprise windfall if HealthLock discovers that you’ve been overcharged in the past. Not only are you protected in the future from mistakes, fraud and theft, HealthLock can help you recover money you’ve already lost due to billing errors occurring in the last 90 days.When you consider the fact that HealthLock includes a 60 day risk-free guarantee, there’s plenty of reason to try it.

Just sign up, see if you were overbilled (or worse), and relax knowing you’re protected against a sudden life-changing medical bankruptcy—and the months or years of undue stress and pain that come with it.

HealthLock Is a Must-Have For Families & Anyone Who Regularly Pays Medical Bills!

Even if you don’t deal with a large number of medical bills, HealthLock can still give you peace of mind—but if you have more than one or two bills a year, or if you’re providing for your family, then HealthLock is a must-have these days.

In most cases, it will pay for itself quickly, if not right away. You could be shocked by the amount of errors that start popping up on your dashboard. With HealthLock, at least you’ll be getting the money back!

If you’re even curious, we highly recommend trying HealthLock out. You can try it 100 percent risk-free for 60 days to see if it’s right for you. Even better, they’re currently offering a discount:

Sign up for HealthLock using the link below, and you’ll lock in your monthly rate at just $17.99, compared to the usual $19.99.

For a small monthly fee, you could avoid months of painful, expensive negotiation. Click the link below to learn more: