Commentary

In the Middle Ages, the Catholic Church, reflecting Plato and Aristotle, considered money lending charging interest to be a grave evil, for reasons ranging from the metaphysical to practical concerns regarding exploitation of the poor and personal responsibility.

While there was never an absolute prohibition of providing credit stated in either the Old or New Testaments, or even in medieval doctrinal pronouncements, any practice or condition that mitigated the integrity of the concept of private property was viewed as problematic.

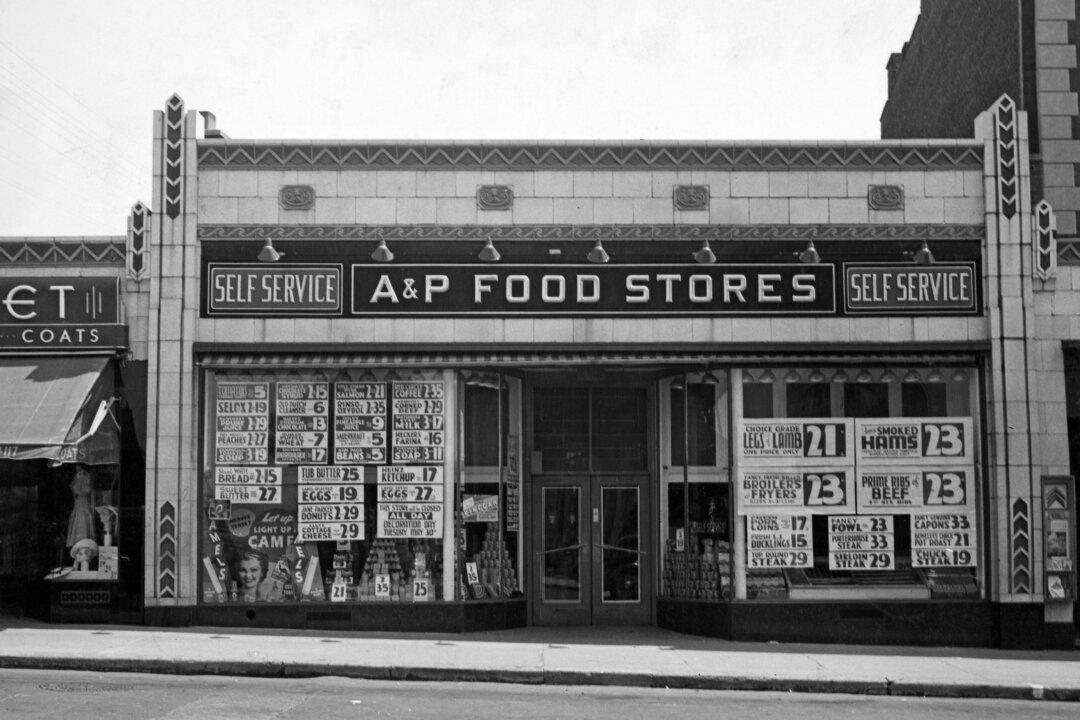

“Lending money at interest gives us the opportunity to exploit the passions or necessities of other men by compelling them to submit to ruinous conditions,” observed the Belgian Jesuit moral theologian Fr. Arthur Vermeersch. Such a description of the practice of loaning may conjure the image of heartless, miserly bankers like Lionel Barrymore’s character Old Man Potter in the film “It’s a Wonderful Life.”

But in the twenty-first century, those overloaded with debt may find that it is not some fat cat creditor but the government who comes a knocking and uses the weight of what they owe to force them to live in ways opposed to their preferences. Personal debt, for example, has become yet another way for the Left to squelch individual choice and make people look to an all-powerful state to provide their various needs and privileges.

The violent shifts from the booming Trump economy to COVID lockdowns to President Joe Biden’s trillion-dollar spending spree not only ignited a rate of inflation unseen for 40 years but also propelled revolving personal debt to record levels. Outstanding credit card debt was $858 billion in March 2020, contracting to $736 billion 13 months later amid the lockdowns. As measured by the Federal Reserve, credit card debt this month reached an unprecedented $993 billion—despite all the stimulus Washington took out of the taxpayers’ pockets in targeted relief.

The $179.4 billion in new credit card debt accrued in 2022 marks the largest sum ever in a single year—$84.9 billion of it coming during last year’s fourth quarter alone, in something of a post-lockdown Christmas shopping catharsis.

Further, CEOs such as JPMorgan Chase’s Jamie Dimon see Americans’ post-COVID eagerness to use their charge cards as a positive sign of prosperity in the months ahead, indicating that consumers are “resilient ... not recessionary.” When people buy lots now and pay later, no question it means they’re confident of the future, and we’re undeniably seeing a collective exhale after the long agony of the coronavirus constraints in economic activity and the accompanying cabin fever.

Americans and many others fortunate enough to be living in free countries are reflexively bullish and optimistic. Their personal circumstances enabled them to have revolving debt loaded within their purses and wallets, and they like to use it. But debt is debt. Sustained high levels of aggregate red ink ultimately mean less investment, especially in the smaller enterprises that generate so many jobs, and will ultimately depress consumer spending power and economic mobility. And when full-blown recession is felt all around them, with its job losses and credit crunches, and this time around in a high-inflation environment, that credit-card balance will suddenly become terrifying. What won’t we do to reduce it when we’re up against the wall?

The federal government possesses the keys to the cell doors of the debtor prisons of today. We have already seen President Biden attempt to politicize personal debt in illegal fashion by rewarding loan forgiveness to the Democrat-heavy constituency of college degree holders—an idea that actually increases consumer debt—but fortunately was stopped by the federal judiciary.

The White House immediately set to work of bypassing the U.S. Supreme Court’s decision last month killing its student debt relief program by seeking to use a questionable interpretation of yet another law. Executive branch regulations would let borrowers be required to pay only a small proportion of their disposable income, calculated minus the costs of housing, food, and other expenses deemed as necessities.

Despite the federal government’s direct involvement in college loans, there is nothing to suggest that the Left in power in the future would not similarly dangle debt relief when it comes to credit card bills.

Not unconditionally, of course. And that is key. Those being offered relief would have to be prejudged according to scrupulously calculated criteria in terms of income, lifestyle, and to encourage desired behavior—with the buying of their votes topping the list.

Want to see that MasterCard balance magically shrink? Sure thing—just reduce your carbon footprint. Or prove that that small business you own hasn’t been homophobic. Or place your children in an approved education (i.e., indoctrination) program. These make up just the tip of the iceberg when it comes to ways today’s Democratic Party can use debt to bribe and manipulate the behavior even of those with whom they disagree on almost everything.

From sending checks directly to citizens; to welfare disguised as tax relief; to outright corruption forcibly funded by taxpayers in the form of government contracts handed to politically favored groups, even on the basis of race—in Washington and in states and cities across party and political divides, government uses cash to coax activity it likes.

No one should imagine that the too-high credit-card balance he or she carries would not be subject to politicians exploiting the “necessities of other men by compelling them to submit to ruinous conditions.” The collective condition of having to accept government help might just be the most accurate definition of socialism there is.