NEW YORK—The Chinese communist regime has been waging an economic war with Western democracies, and U.S. companies, financial services, and regulators need to do more to counter the threat, a group of experts warned on April 25.

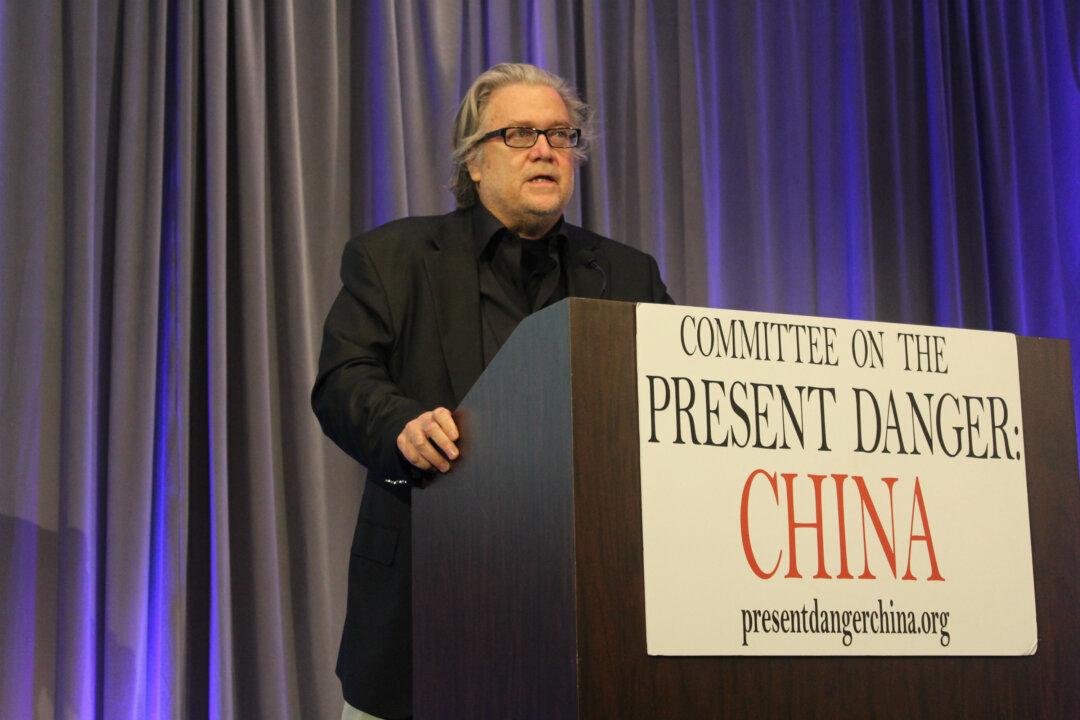

A recently formed coalition of national security, financial, and human rights experts, called the Committee on the Present Danger: China, held a conference at a Manhattan hotel discussing the Chinese Communist Party’s (CCP) unrestricted economic warfare against the United States, highlighting the threat posed by the Chinese regime’s economic ascendency, as well as the role U.S. companies and capital have played in fueling its rise.