Live

China Will Be Hit With 104 Percent Tariffs at Midnight; US Starts Negotiating With Top Partners

The higher tariffs comes after Beijing rejected Trump’s demand to halt its retaliatory levies. Bessent said he expects trade deals to happen ‘quickly.’

premiere

[PREMIERING 9PM ET] No Chemicals, No Vaccines, No Subsidies: Inside Joel Salatin’s Farming Revolution

Salatin is one of America’s most revered regenerative farmers and the author of 17 books, including ‘Everything I Want To Do Is Illegal.’

Back Story Gone Awry: Dickens’s Fagin Gets a New Treatment

Allison Epstein wastes her talent in ‘Fagin The Thief,’ trying to right literary wrongs by revising a serial child exploiter.

‘Your Friends & Neighbors: Season One’: A New Morality Play

Jon Hamm revisits ‘Mad Men’ and ‘Landman’ by playing an appealing anti-hero.

Andrew Marvell’s ‘The Garden’ and the Restorative Power of Nature

‘The Garden’ by 17th-century English poet Andrew Marvell covers much ground, from the benefit of alone time in nature to the soul’s search for a divine Creator.

Most Read

Top Stories

Supreme Court Blocks Reinstatement of Fired Federal Workers for Now

The president asked the high court to intervene after a lower court judge ordered the administration to reinstate thousands of probationary workers.

Judge Orders White House to Restore AP’s Access to Press Pool

The news wire service had been kicked out after it refused to use the name ‘Gulf of America.’

Day in Photos: Military Exercises in Romania, Nightclub Roof Collapse, and Blue Diamond Debut

A look into the world through the lens of photography.

Why US Has Upper Hand Over Beijing in Tariff Standoff

Experts say the tariff standoff is beyond economic conflict; Trump and Xi are contesting U.S. economic might versus communist political control.

Trump Seeks Coal Rebound to Meet Booming Electricity Demand

The president issues executive actions designed to revive 19th century industrial mainstay to power 21st century economy.

Maine Sues USDA Over Funds Frozen for Allowing Male Athletes in Female Sports

The loss of funds will keep schoolchildren from being fed, the suit says. The USDA chief says the funding pause ‘does not impact federal feeding programs.’

Judge Rejects Nonprofits’ Request to Block Homeland Security Grant Terminations

The judge said the plaintiffs were unlikely to succeed in showing that her court had jurisdiction over certain claims.

Appeals Court Clears Way for DOGE to Access Data at 2 Agencies

The Fourth U.S. Circuit panel reversed an injunction sealing off personal records in the Education Department and the Office of Personnel Management.

Dominican Republic Nightclub Roof Collapse Leaves at Least 60 Dead, 160 Injured

Emergency workers are still searching for victims who may still be alive.

Unprecedented Job Swaps of CCP Officials Indicate Xi’s Waning Power: Analysts

It’s ‘extraordinary’ that the heads of two crucial state departments swapped roles midway through their five-year terms, an analyst says.

Foods That Lower the Risk of Tinnitus and Foods That Can Trigger it

New research found that some high quality food groups may offer protection from tinnitus.

▶Shen Yun Inspires ‘Compassion and Kindness,’ Says Company Director

Shen Yun Performing Arts entranced the audience at the David H. Koch Theater at Lincoln Center in New York City, on April 2.

Hegseth Vows US–Panama Cooperation to Curb Chinese Influence Over Canal

The defense secretary also praises Panama’s president for cutting ties with China’s Belt and Road Initiative.

IRS Agrees to Share Data With Homeland Security on Illegal Immigrants

Court papers filed on Monday confirmed the agencies signed a memorandum of understanding.

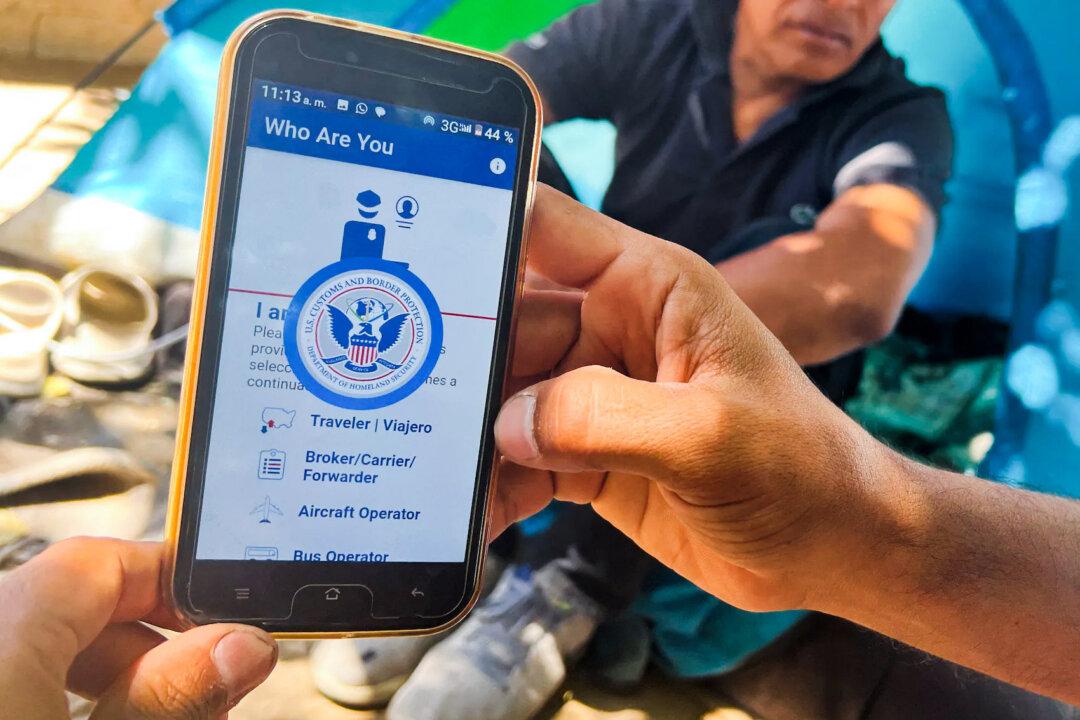

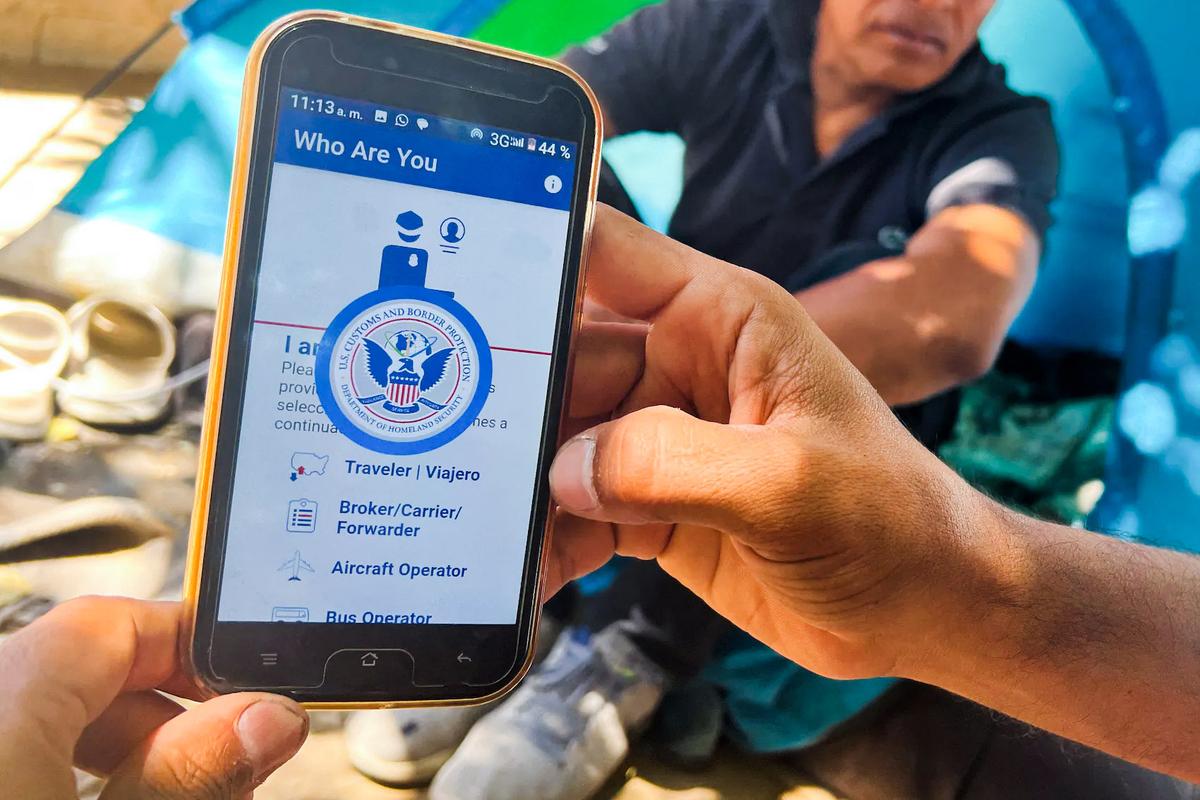

DHS Revokes Legal Status of People Who Entered the US Using CBP One App

The app was shut down shortly after President Donald Trump took office.

Harvard to Borrow $750 Million Amid Federal Funding Uncertainty

The Ivy League school faces heightened scrutiny over its access to $9 billion in federal funding.

Tracking Trump’s High Level Appointments, Senate Confirmations

The Senate is undertaking the confirmation process for the president’s new administration.

EU to Issue Antitrust Ruling on Apple, Meta Within Weeks

Brussels’s antitrust chief Teresa Ribera told the European Parliament that the ruling, previously expected in March, was on its way.

Senate Confirms Elbridge Colby as Pentagon Defense Policy Chief

The new undersecretary of defense could be tested soon over his policy preferences in U.S. military strategy.

Used Car Prices, Inventories Decline in March: Manheim Index

However, prices could rise as a result of newly announced auto tariffs by the Trump administration.

Cherishing Judaica: Jewish Objects Around Boston

The ‘Intentional Beauty’ of Jewish craftsmanship is in an exhibition at the Museum of Fine Arts, Boston.

Special Coverage

Special Coverage

![[PREMIERING 9PM ET] No Chemicals, No Vaccines, No Subsidies: Inside Joel Salatin’s Farming Revolution](https://www.theepochtimes.com/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2025%2F04%2F08%2Fid5838751-250408-ATL_Joel-Salatin_HD_TN-600x338.jpg&w=1200&q=75)

![[LIVE Q&A 04/09 at 10:30AM ET] US Moves to Seize Property of Illegal Immigrants, Promote ICE Hotline | Live With Josh](https://www.theepochtimes.com/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2025%2F04%2F08%2Fid5838874-040925_REC-600x338.jpg&w=1200&q=75)