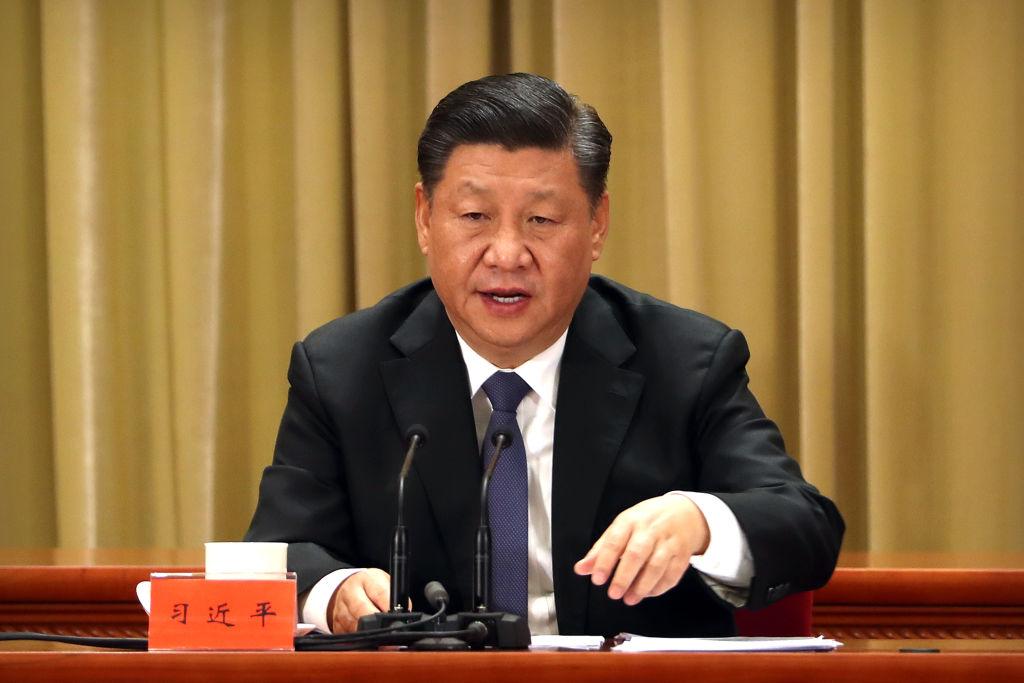

At a high-level meeting of senior Chinese Communist Party officials held in Beijing, Chinese leader Xi Jinping gave an opening speech on Jan. 21 that hinted at the severity of China’s economic downturn.

“Improve the ability to prevent and control risks,” and “maintain healthy economic development and overall social stability,” Xi instructed the cadres.