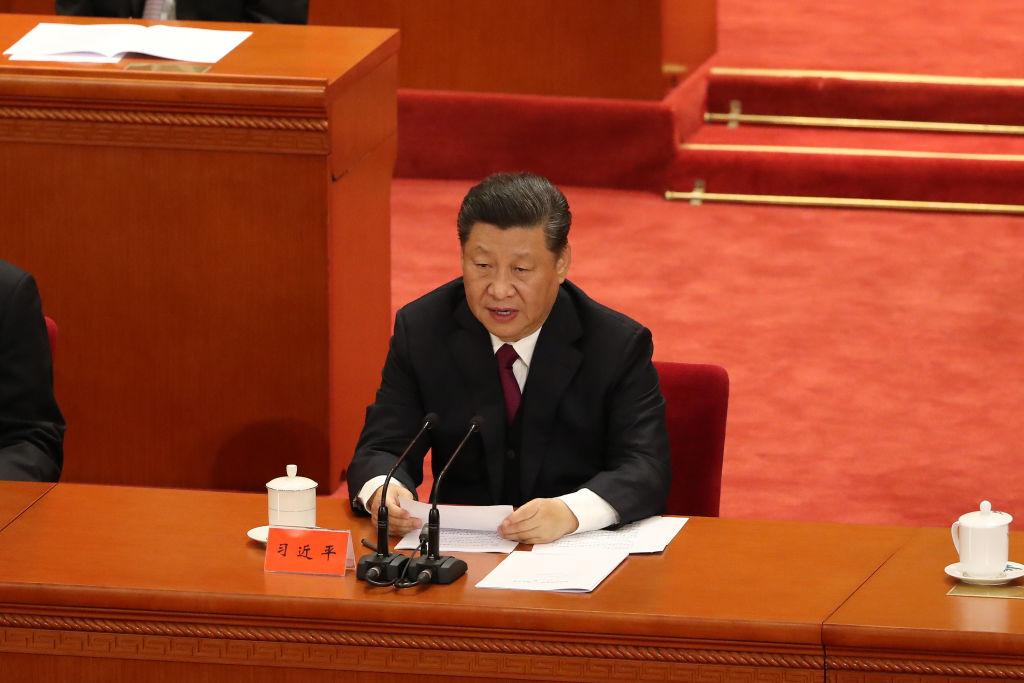

China’s next move in the ongoing trade war with the United States is under close scrutiny, after Chinese leader Xi Jinping recently visited a Chinese rare-earth mining and processing company in southeastern China’s Jiangxi Province.

Rare-earth elements, such as lithium and cobalt, are considered the fuel of the next century, as they are needed to produce critical components within many key technologies such as electric vehicles, smartphones, wind turbines, satellites, missiles, and semiconductor chips.