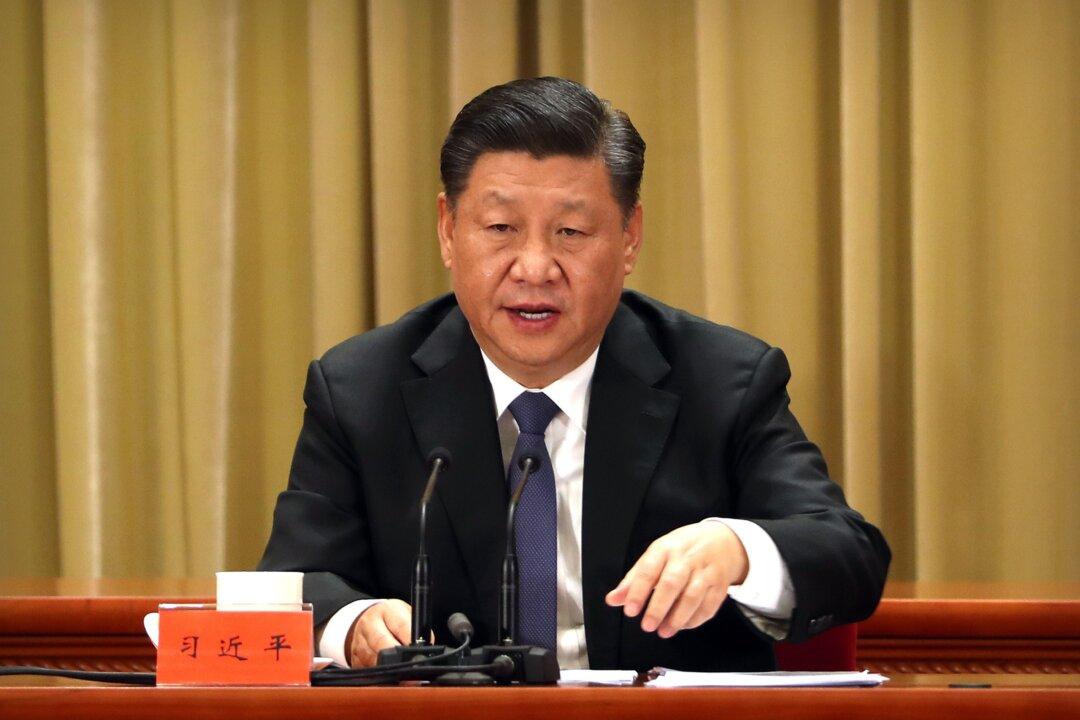

BEIJING—China should seek stable development of its economy while not forgetting to fend off risks to its financial system, Chinese leader Xi Jinping said at a recent study session held for senior Communist Party officials.

Preventing and resolving financial risks, especially systemic financial risks, is a fundamental task, Xi told officials on Feb. 22.