WASHINGTON—Chinese buyers have canceled U.S. soybean orders and shifted their purchases to South America in the past few months to avoid new tariffs between the United States and China. However, China is still dependent on U.S. supplies and will have to turn to American farmers after September, according to Morgan Stanley.

Soybean prices in Chicago have slid 16 percent since the beginning of trade disputes in early April, hurting U.S. farmers.

“Although rearrangements in global trade can smooth out the impact on prices for local consumers, we believe China will end up paying the bill,” Morgan Stanley analysts said in a report.

China is still dependent on U.S. soybeans in the medium term and, hence, prices in Chicago will soon start to recover, according to the report.

“China needs U.S. producers to be profitable to keep the balance in the market.”

China is the world’s biggest soybean consumer, accounting for more than half of global imports. And the United States is the largest soybean producer in the world, with almost 40 percent of China’s imports from American producers, according to Morgan Stanley.

In early July, China implemented a 25 percent import tax on several commodities, including soybeans, from the United States, in response to U.S. tariffs on Chinese goods. Soybean growers have been among those hit hardest as soybeans alone account for 10 percent of total U.S. exports to China.

Prices in Chicago fell as Chinese consumers shifted their purchases from the United States to Brazil and Argentina ahead of the import tariffs. China, however, cannot solely rely on these countries, according to Morgan Stanley.

“Brazil and Argentina are unable to supply all of China’s needs, especially after both a drought that led to a 40 percent year-on-year fall in Argentine production, and freight issues in Brazil,” the report said.

Brazil is No. 2 and Argentina is No. 3 among producers of soybeans worldwide.

According to the report, China imported 97 million tons of soybeans, compared with the 76 million tons produced in South America, during the 2017–2018 season. Due to this supply gap, China is still dependent on U.S. production to maintain the global supply-demand balance.

“Still, we think the current uncertain environment and commodity prices do not incentivize the opening of new areas in Brazil and Argentina,” the report said. “Therefore, in the medium term, China is likely to continue to depend on U.S. imports and the [price] discount of Chicago versus South America should narrow going forward.”

In addition, the Brazilian soybean marketing season ends when the U.S. soybean harvesting season is beginning in September. Hence, international buyers, including China, are expected to turn to U.S. supplies as most Brazilian harvests will be exported by then.

By the fourth quarter, “China will have to buy U.S. soybeans and this will likely push prices in Chicago back above $9.5 per bushel,” said the Morgan Stanley report.

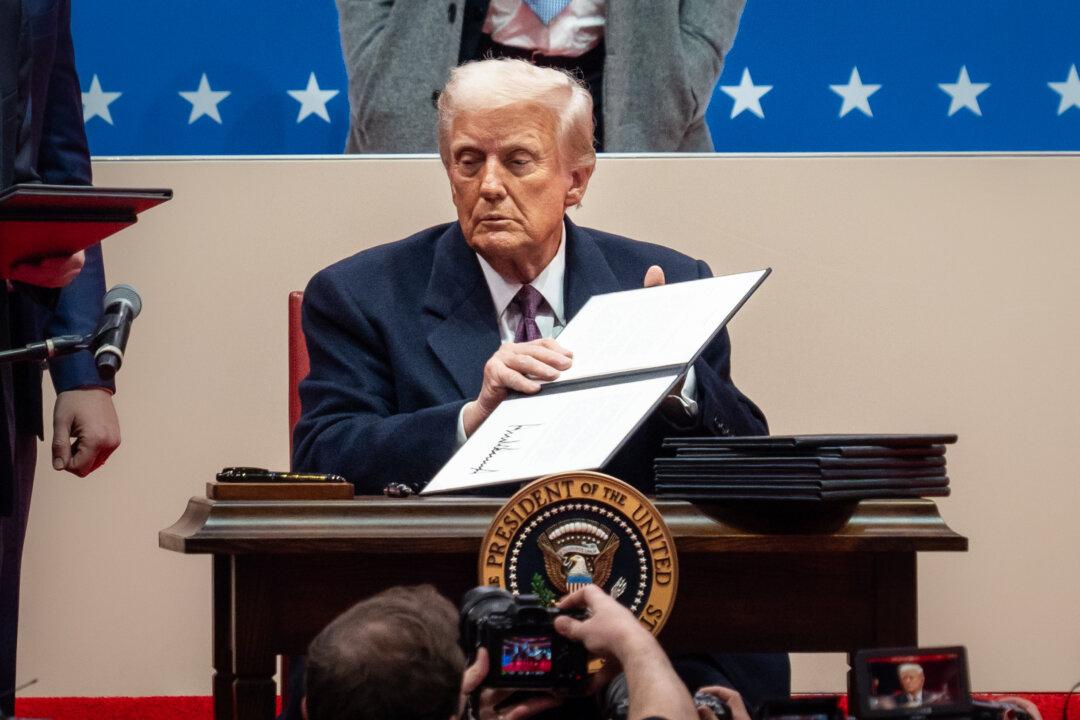

In July, China and the United States started imposing mutual tariffs on some $34 billion worth of goods, and the Trump administration is expected to implement more tariffs for another $16 billion worth of Chinese goods.

In addition, the White House is considering boosting tariffs on $200 billion worth of goods to 25 percent, up from the 10 percent announced in early July. In response, Beijing on Aug. 3 announced retaliatory tariffs on $60 billion worth of U.S. agricultural, metal and chemical products.