A California bill that would add another 11 percent in state taxes to firearms and ammunition sold in the state passed its first hurdle in the Legislature April 11.

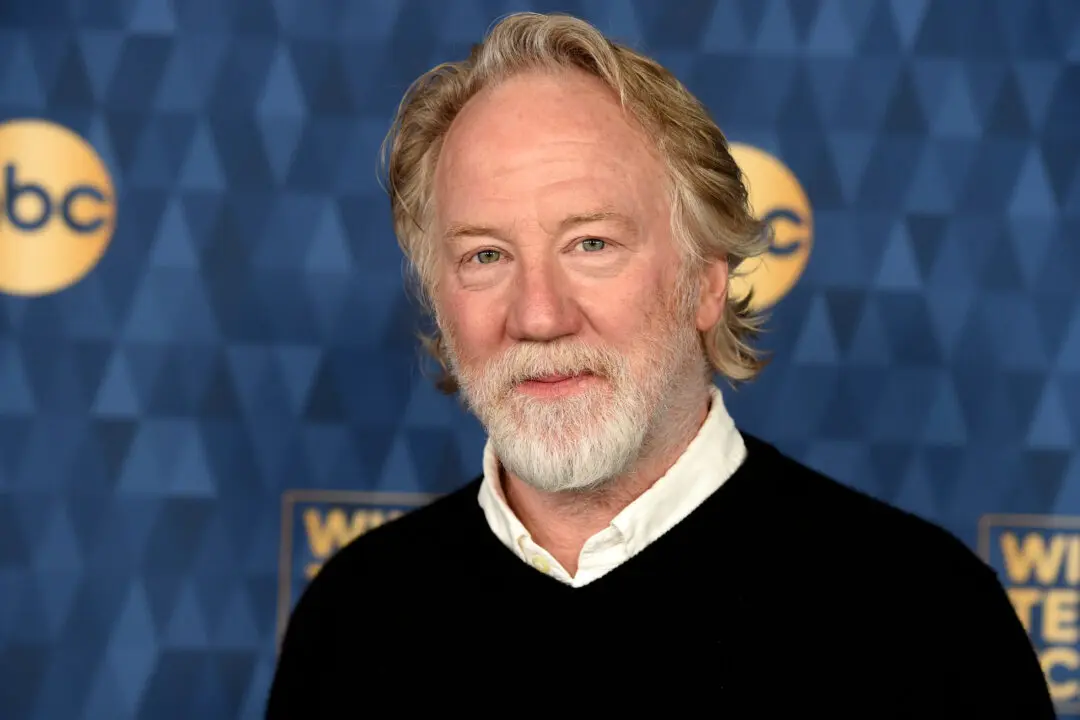

The Assembly’s Public Safety Committee voted in favor of Assembly Bill 28, introduced by Assemblyman Jesse Gabriel (D-Woodland Hills), despite opposition from several state law enforcement groups, the National Rifle Association, conservation groups, and shooting sports organizations. Two Republican committee members voted against the measure.