Commentary

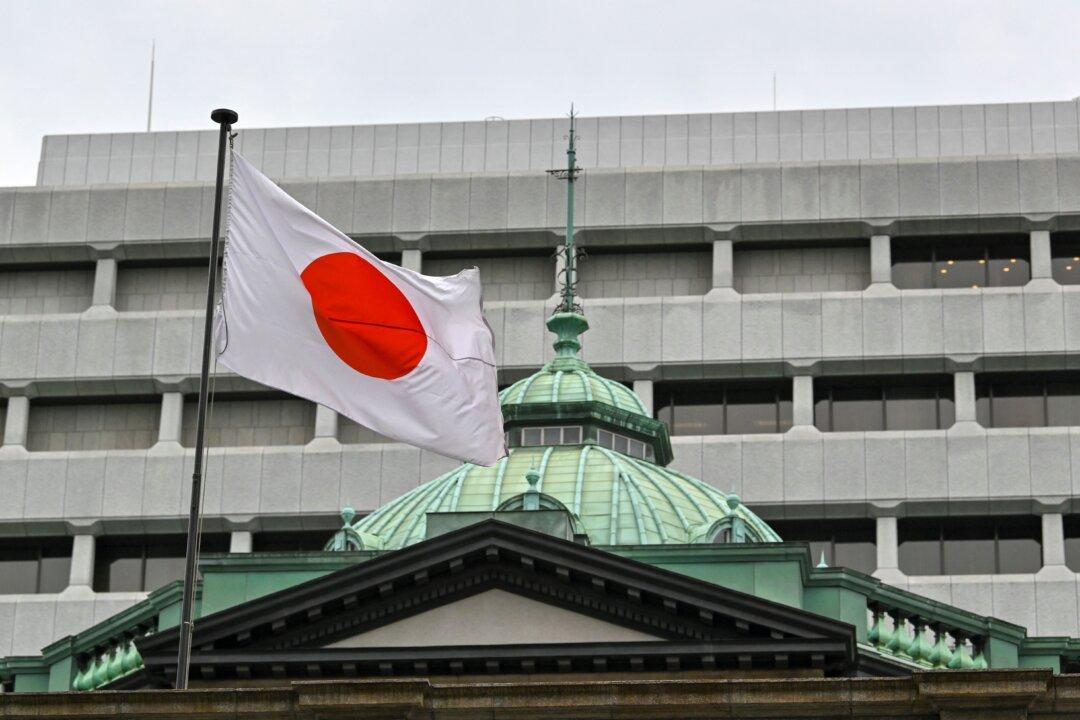

The Japanese yen is once again flirting at 150 to the U.S. dollar, a year after a massive solo intervention in the foreign exchange market to stem the yen’s precipitous fall by the Bank of Japan on behalf of the ministry of finance, without the U.S. Treasury’s participation. The October 2022 intervention was meant to punish speculators once and for all, teaching them a lesson on the costs associated with their positions. Well, they probably learned a lesson that their bet couldn’t always be one way. At the same time, many of them must have revisited their strategy and confirmed its long-term validity. So they held onto the strategy, driving the yen back to where it was last October.