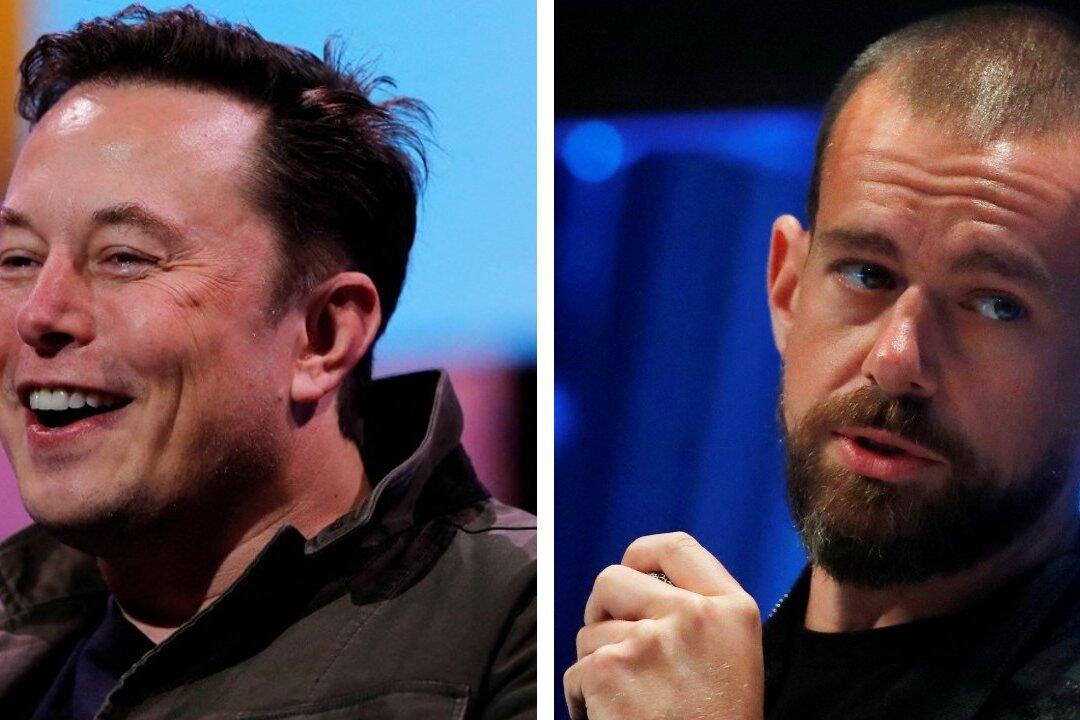

A new filing released by the Securities and Exchange Commission on May 17 revealed further details of Elon Musk’s $44 billion deal to take Twitter private, giving the public a more complete picture of the negotiations leading up to the acquisition.

The filing, submitted by Twitter Inc., describes a series of close negotiations between Musk and Twitter co-founder and former CEO Jack Dorsey, in which Dorsey appeared to encourage Musk in his takeover of the company.