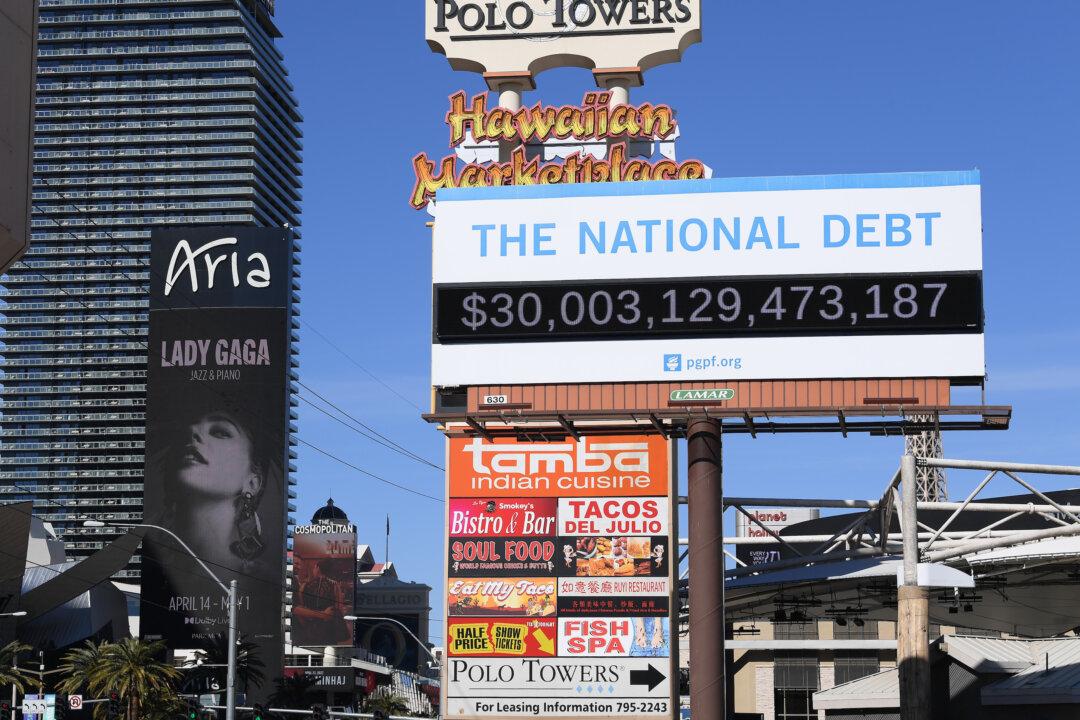

New Jersey has amassed a huge, and possibly dangerous, level of debt, according to a new report that reviews the financial health of state governments across the country.

Each Garden State taxpayer owes tens of thousands of dollars and the state is a tax “sinkhole,” according to the nonprofit organization Truth in Accounting (TIA), because state lawmakers of both parties have overspent and used accounting “gimmicks” for decades. The organization defines “sinkholes” as states that lack the necessary funds to pay their bills.