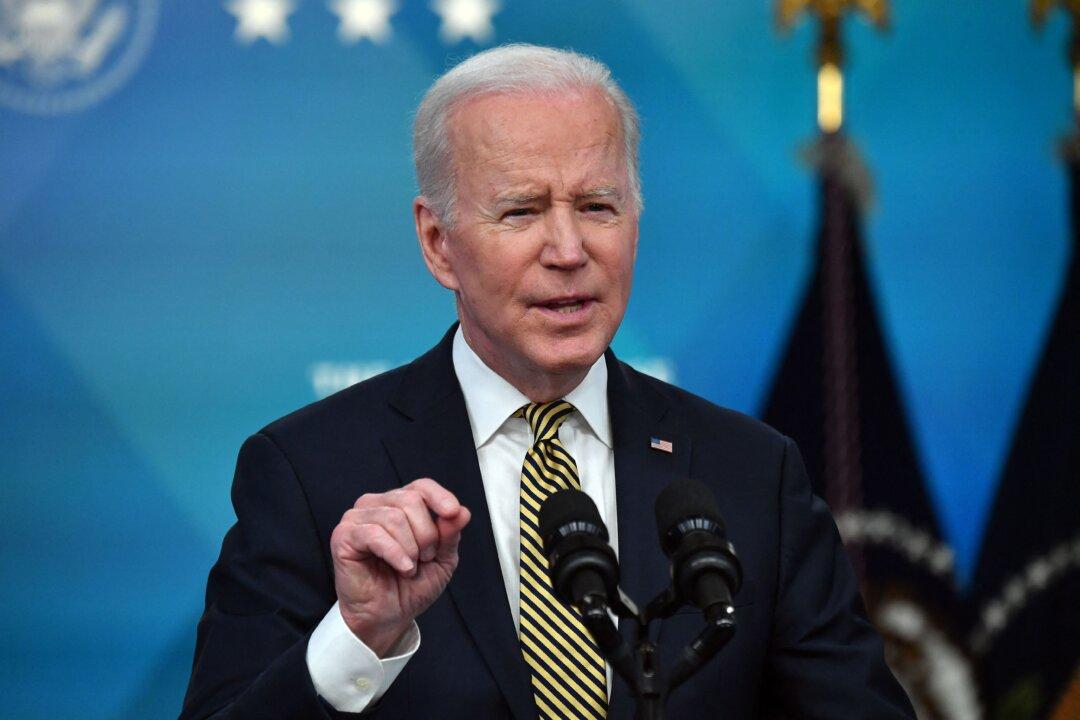

WASHINGTON—President Joe Biden released his $5.8 trillion budget for fiscal year 2023 on March 28, including significant funding for law enforcement, in an effort to set himself apart from progressives in his party who have advocated for defunding the police.

Biden also called for more defense spending and a new minimum tax targeting the rich.