When the history of this year’s presidential campaign is written, one of its more remarkable features will be that candidates of both parties feel it necessary to talk about income inequality. Surely that makes this a watershed moment.

The issue is hardly new. As historian and writer Jill Lepore pointed out last year, income inequality in the United States has been rising since the late 1960s. As she put it, “The evidence that income inequality in the United States has been growing for decades and is greater than in any other developed democracy is not much disputed.”

The evidence that income inequality in the United States has been growing for decades and is greater than in any other developed democracy is not much disputed.

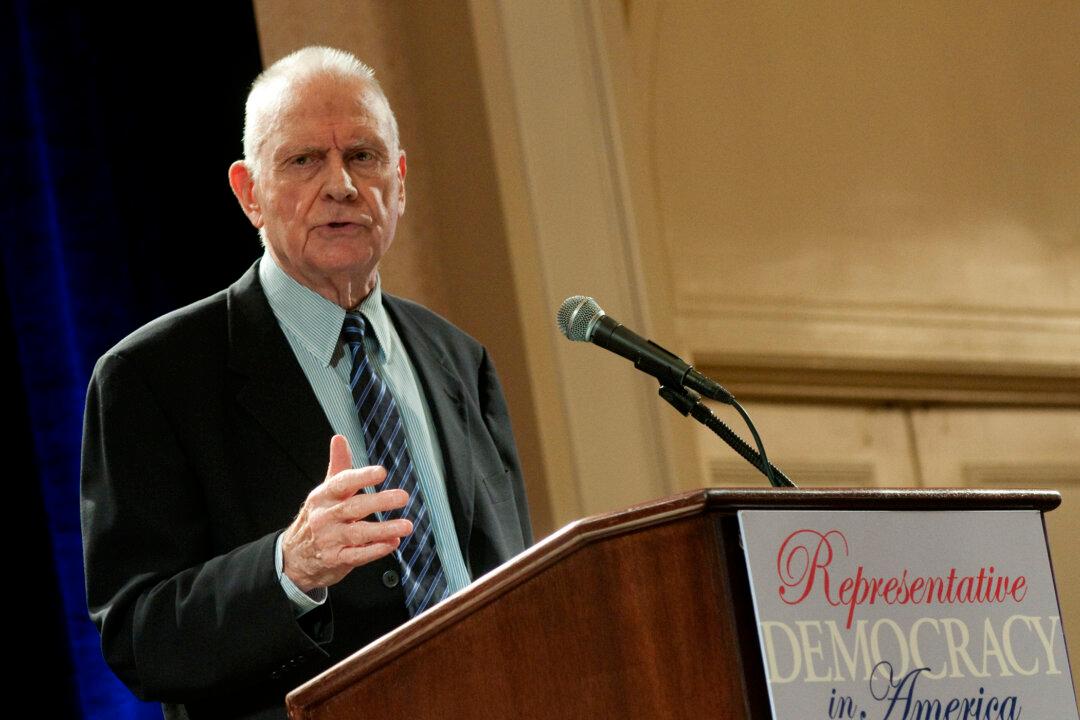

, historian and writer