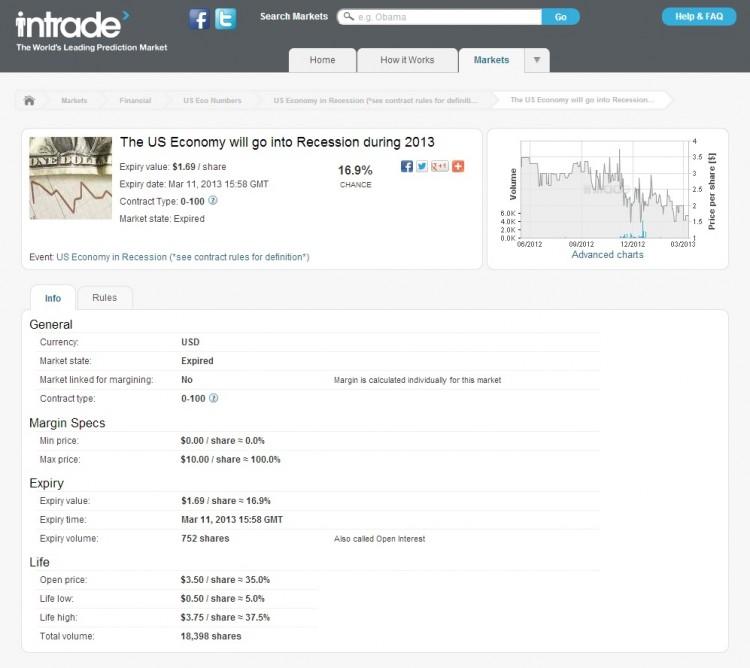

Online prediction market Intrade shut down operations March 11. The company, based in Ireland, cited financial irregularities which prompted an investigation. Intrade settled all open trades and froze all company accounts until further notice.

“Circumstances require immediate further investigation, and may include financial irregularities,” the online betting company says on its website. Irish law forced Intrade to:

- Stop trading activities

- Close and settle all open positions

- Freeze company and client bank accounts

The company, founded in Dublin by John Delaney in 1999, enabled customers to place bets on the outcome of any type of event, whether it was the U.S. presidential election or a celebrity’s wedding.

The company enjoyed financial success and stated that Wall Street as well as politicians used its market odds for prediction and analysis.

Over the years, some irregularities emerged, however. Intrade’s parent company Trade Exchange Network Limited (TEN) paid $150,000 to the Commodities Futures Trading Commission (CFTC) to settle a charge regarding commodity option contracts that it could not offer in the United States.

In the fall of 2012, the CFTC found that Intrade did not comply with the settlement and violated some new U.S. regulations that were introduced in the wake of the 2008 financial crisis.

The CFTC charged Intrade with “offering commodity option contracts to U.S. customers for trading, as well as soliciting, accepting, and confirming the execution of orders from U.S. customers, all in violation of the CFTC’s ban on off-exchange options trading.”

The company then ceased offering its services to U.S. customers in December 2012, a heavy blow as the United States was Intrade’s biggest market.

A February 2013 report by its auditor Caulfield Dunne highlighted other problems. The report cited “insufficient documentation regarding payments made into bank accounts in the name of a deceased former director and other third parties,” according to a Business Week report. The company’s founder John Delaney had died in an effort to climb to the summit of Mr. Everest in 2012.

Intrade will cease operations until the investigation is complete and members cannot withdraw their funds at this moment.

“At this time and until further notice, it is not possible to make any payments to members in accordance with their settled account balance until the investigations have concluded,” the company statement says.

The Epoch Times publishes in 35 countries and in 21 languages. Subscribe to our e-newsletter.