No Fed Involvement in Watergate, Says IG

It’s no secret that Republican presidential candidate Ron Paul is no fan of the Federal Reserve. Paul has made numerous allegations against the U.S. central banking system, and has even called to abolish it.

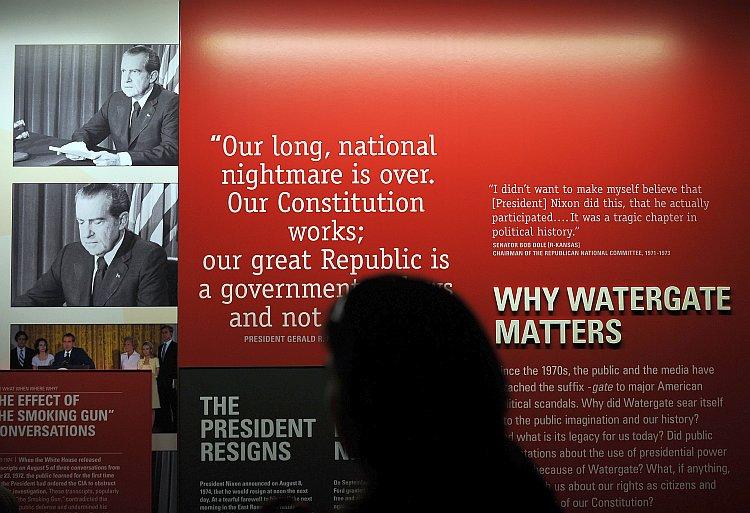

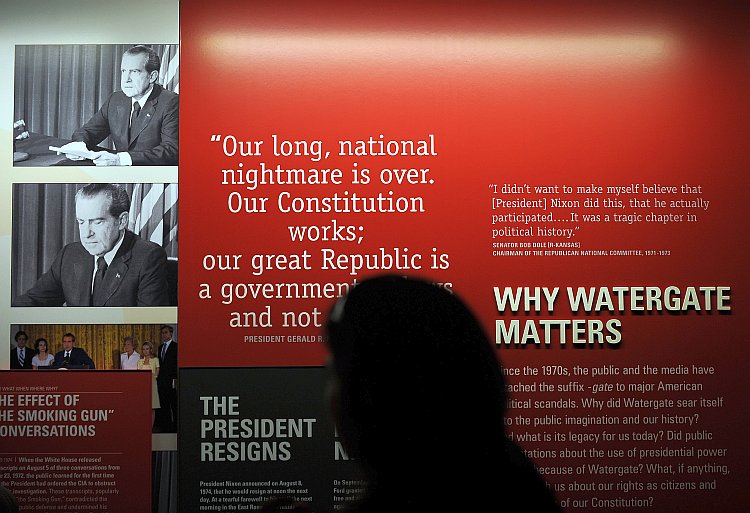

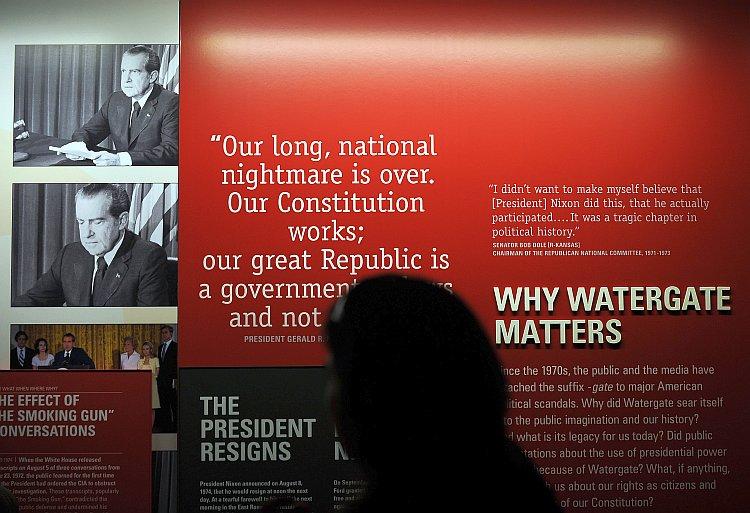

For years, Republican presidential candidate U.S. Rep. Ron Paul (R-Texas) has railed against the Federal Reserve Bank. But a recent report investigating allegations Paul had raised against the Fed 2 years ago says there’s no cause for alarm. Chip Somodevilla/Getty Images

|Updated: