If you find yourself feeling anxious about the near-term economic horizon post-COVID-19, you’re in the same position as everyone else, including the so-called “experts.” What we’re seeing is a confusing market, and a market entirely confused. Sharp rallies take place despite dismal economic data. Large volatile fluctuations erasing any notion of directional significance. And when it comes to attempting any form of intelligible forecast, we don’t have enough information to guess what might happen in the next quarter, let alone the coming year.

Economists seem divided on the current state of the economy, with some calling for a recovery, and others calling it a prelude to another great depression. Typically, when panic-selling brings equities down to bear-market levels, we see large investors, like Warren Buffett, buying with a great deal of optimism, while retail investors are too spooked to jump back in. Today’s situation shows the opposite, with the retail crowd confident of recovery while Buffett, Dalio, and a host of other big players hold off on stock purchases.

At the precipice of yet another potential economic meltdown, it would be foolish to remain optimistic. By the very same token, seeing the market from a pessimistic perspective would be equally foolish. There’s no place for personal market sentiment when the situation is as perilous as the one we’re currently facing. There’s room only for objectivity, prudence, and shrewd market opportunism.

The Dollar’s Purchasing Power Is Eroding Fast

As a gold investor, you’re probably well aware of this. Economic stimulus by way of the printing press never ends well for the dollar. Before the summer of 2019, the Fed was quickly trying to unload its balance sheet. With pressure from the Trump administration, the Fed reversed course, keeping rates steady before loading up its balance sheet once again.Ultimately, what’s at stake is the dilution of the dollar.

Our purchasing power is getting destroyed, and at a pace far greater than what any equity-based return can do to compensate for it.

1. Hold Just Enough Cash at the Bank to Cover up to 90 Days’ Worth of Bills and Luxuries

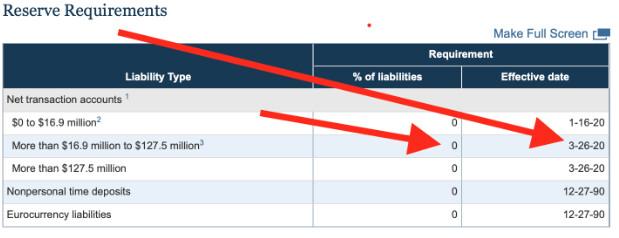

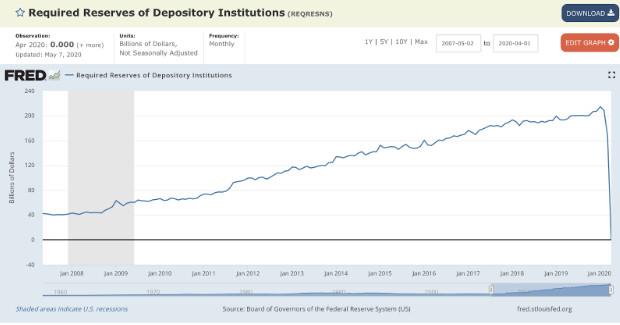

We clearly see the banks are experiencing a liquidity crisis, according to the vast lending programs on the Federal Reserves Dashboard, recently revealed on its site. Additionally, as of March 26, the Reserve Capital requirements for major banking institutions, with more than $127.5 million, hade dropped to zero, and now the banks are not required to keep any cash on hand for you in the event that you wanted some.2. Convert Cash to Gold and Silver

In light of purchasing power erosion, the logic behind this is pretty straightforward: The Fed’s money printing will dilute any assets that are dollar-based—cash, bonds, stocks, you name it. Their values rest on the value of the dollar. But gold and silver both have intrinsic value that stands apart from government-issued currency.The Fed can print and manipulate dollars, but it can’t create or manipulate gold and silver.

Strangely, mainstream investors understand only half of this logic. Ever since the coronavirus crash, gold and silver ETFs have been experiencing tremendous inflows from investors seeking a safe haven. Paper gold and silver are not the same as their physical counterpart. You can’t convert them into the real metals, hence you don’t own any silver or gold, just promissory notes. The only real portfolio hedge comes in the form of physical coins or bullion.

Personally, I feel safer knowing that I can access my own stash of silver and gold.

3. Keep Excess Metals Beyond 90 Days Locked in Safe Storage Away From Home

Should our economy fall into depression, there will be second-order risks stemming from our financial circumstances. One of the most frightening scenarios is that our social fabric gets torn apart, possibly to a point where it’s every individual, group, or family unit for itself. This likely would entail a period of looting, theft, and violence.DDSC in Wilmington Delaware allows you quick access to cash from your gold and silver, which can be wired into any checking or savings account of your choosing, within hours. It also gives your family the security of having beneficiaries designated if anything were to happen to you.