Sponsored Content

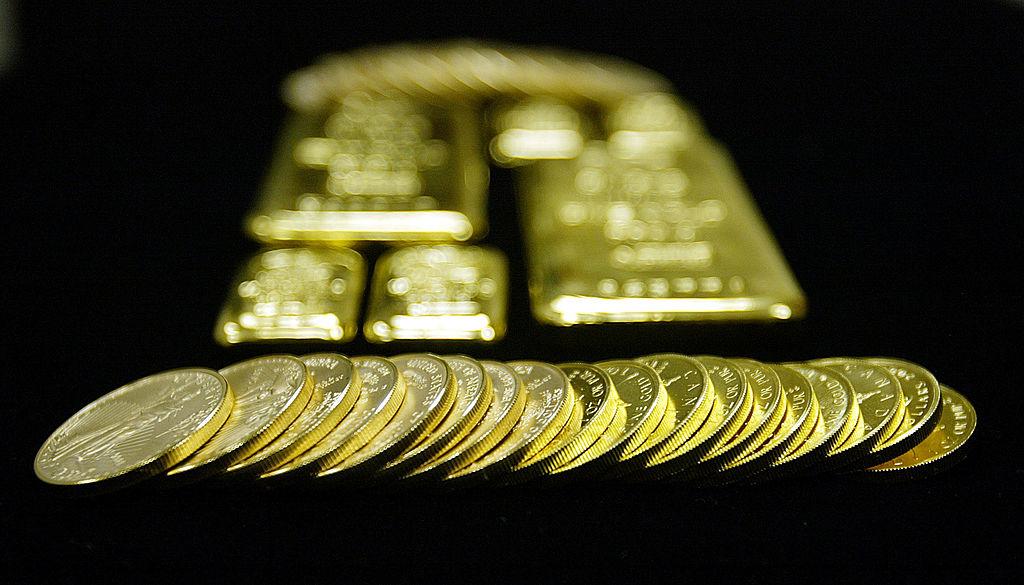

What Is the True Cost of Gold?

Is this question even adequate to address the realities of pricing? When you buy gold, what exactly are you paying for?These are tricky questions for several reasons:

- The cost of gold is never fixed—it’s subject to fluctuations based on supply and demand.

- The cost of gold depends on what the market is willing to pay for it—buyers and sellers on the commodity level negotiate a favorable price they agree on, and that moves the price.

- When you pay for a gold coin or bar, you are paying not only for a “product” but a share of the entire production “process.”