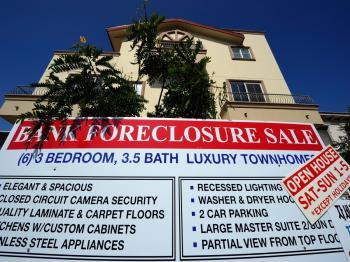

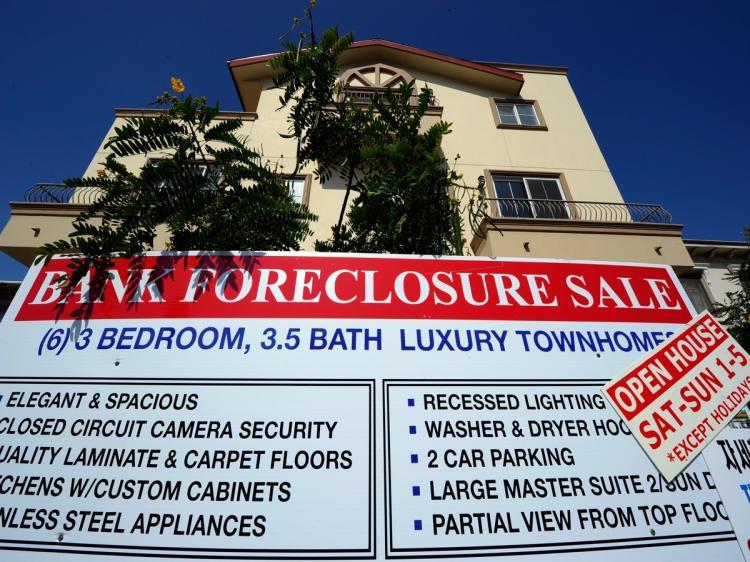

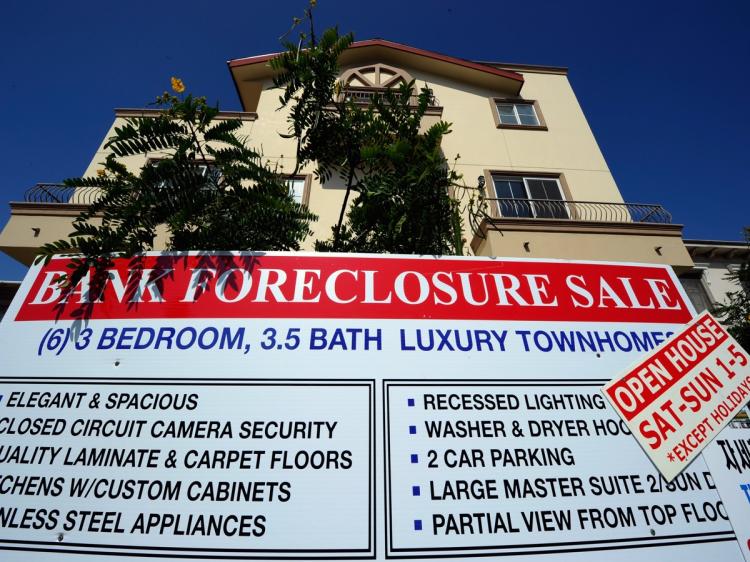

U.S. homes lost to foreclosures have hit an all time high in August. According to RealtyTrac Inc. the number of home repossessions is up 3 percent from July, bringing the total to 95,364 properties, an increase of 25 percent from August 2009.

The Irvine, Calif.-based data provider has been accumulating research since 2006. The firm monitors notices for defaults, scheduled home auctions, and home repossessions—warnings that result in a home ultimately going into foreclosure. One in every 381 housing units received a foreclosure filling in August, according to the report. It appears that the outlook is rather bleak, prompting more pressure on a U.S. housing market recovery, which is impacted by other economic factors. Rising unemployment, volatile consumer confidence, coupled with the federal homebuyer tax incentive concluding in April, are all factors to consider.

U.S. home sales have been dramatically affected, so according to Rick Sharga, a RealtyTrac senior vice president, “these (properties) are going to come to market, but very slowly because nobody wants to overwhelm a soft buyer’s market with too much distressed inventory for fear of what it would do for house prices,” reports AP.

August marks the ninth consecutive increase of homes lost to foreclosure on an annual basis. The last previous high was in May.

At least 2.3 million homes have been repossessed by lenders since the recession began in December 2007, according to RealtyTrac. The firm forecasts that more than 1 million American households are likely to lose their homes to foreclosure in 2010.

“We’re on track for a record year for homes in foreclosure and repossessions,” said Sharga, in a telephone interview with Bloomberg. “There is no improvement in the underlying economic conditions.”

According to Mark Zandi, chief economist of Moody’s Analytics in West Chester, Pa., around 2 million houses will be seized by lenders through 2011. Home sales this year will be 7 percent below the 2009 total, Fannie Mae, the largest U.S. mortgage finance company, said in a report dated Sept. 6.

Although the Obama administration hoped to curb the mortgage crises, almost half of the 1.3 million homeowners who enrolled in the Obama administration’s mortgage-relief program abandoned the initiative.

The program, called Making Homes Affordable, has managed to offer assistance to around 422,000 homeowners since March 2009.

The socio-economic impact of home repossession is also being reported by ComPsych, which has tracked employee assistance calls since 1984. The company, which provides employee assistance programs to 13,000 organizations with 33 million workers worldwide, announced that housing problems have for the first time replaced child care as the No. 1 subject of employee assistance calls.

Of more than 25,000 calls from January to June 2010, 41 percent were related to moving. Of those, 77 percent sought help finding an apartment, and two-thirds of those seeking apartments said it was “foreclosure related.”

“People are calling us at the point where they don’t have alternatives,” says ComPsych CEO Richard Chaifetz. “We have sent people with no money to shelters. Their credit is terrible, and we have to buy them time. We’ve gotten calls from people that have been thrown out on the street, and that’s when they call.”

The Irvine, Calif.-based data provider has been accumulating research since 2006. The firm monitors notices for defaults, scheduled home auctions, and home repossessions—warnings that result in a home ultimately going into foreclosure. One in every 381 housing units received a foreclosure filling in August, according to the report. It appears that the outlook is rather bleak, prompting more pressure on a U.S. housing market recovery, which is impacted by other economic factors. Rising unemployment, volatile consumer confidence, coupled with the federal homebuyer tax incentive concluding in April, are all factors to consider.

U.S. home sales have been dramatically affected, so according to Rick Sharga, a RealtyTrac senior vice president, “these (properties) are going to come to market, but very slowly because nobody wants to overwhelm a soft buyer’s market with too much distressed inventory for fear of what it would do for house prices,” reports AP.

August marks the ninth consecutive increase of homes lost to foreclosure on an annual basis. The last previous high was in May.

At least 2.3 million homes have been repossessed by lenders since the recession began in December 2007, according to RealtyTrac. The firm forecasts that more than 1 million American households are likely to lose their homes to foreclosure in 2010.

“We’re on track for a record year for homes in foreclosure and repossessions,” said Sharga, in a telephone interview with Bloomberg. “There is no improvement in the underlying economic conditions.”

According to Mark Zandi, chief economist of Moody’s Analytics in West Chester, Pa., around 2 million houses will be seized by lenders through 2011. Home sales this year will be 7 percent below the 2009 total, Fannie Mae, the largest U.S. mortgage finance company, said in a report dated Sept. 6.

Although the Obama administration hoped to curb the mortgage crises, almost half of the 1.3 million homeowners who enrolled in the Obama administration’s mortgage-relief program abandoned the initiative.

The program, called Making Homes Affordable, has managed to offer assistance to around 422,000 homeowners since March 2009.

The socio-economic impact of home repossession is also being reported by ComPsych, which has tracked employee assistance calls since 1984. The company, which provides employee assistance programs to 13,000 organizations with 33 million workers worldwide, announced that housing problems have for the first time replaced child care as the No. 1 subject of employee assistance calls.

Of more than 25,000 calls from January to June 2010, 41 percent were related to moving. Of those, 77 percent sought help finding an apartment, and two-thirds of those seeking apartments said it was “foreclosure related.”

“People are calling us at the point where they don’t have alternatives,” says ComPsych CEO Richard Chaifetz. “We have sent people with no money to shelters. Their credit is terrible, and we have to buy them time. We’ve gotten calls from people that have been thrown out on the street, and that’s when they call.”