The annual World Economic Forum (WEF) has concluded its five-day proceedings in Switzerland; a meeting of the minds of more than 2,500 of the world’s leading business and political figures.

This occasion marks the place where negotiations and deals are made, and the event is also indicative of the overall climate of global economic discussions. Bono, international celebrity, lead singer of the rock band U2, and past WEF attendee was noticeably missing. Also absent were Google Inc. CEO Larry Page and Facebook Inc.’s Mark Zuckerberg.

The European debt crisis was the center of discussion, and the general sentiment was pessimistic. Straddling the timing of the Davos meeting were the ongoing discussions Greece is having with its debt holders. The nation is due to make a massive bond interest payment in March and does not have the funds to do so.

There were tense negotiations among Greece, the International Monetary Fund (IMF), and banks and creditors over the weekend regarding possible haircuts (reductions in loan amounts Greece owes creditors) and the restructuring of debt. Greece would like creditors to write down half of the 200 billion euros in debt it owes.

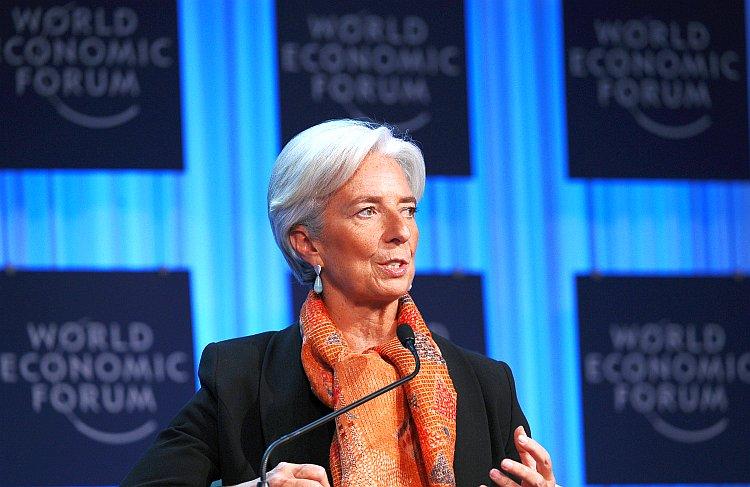

The impact of the European Union’s financial woes has international consequences. IMF head Christine Lagarde said that Europe’s crisis has “collateral effects, [and] spillover effects around the world. What I have seen, and what the IMF has seen in numbers and forecasts, is that no country is immune, and everybody has an interest in making sure that this crisis is resolved adequately.” Traditionally, the IMF has acted as the world’s lender of last resort, and Lagarde has attempted to boost its reserves by $500 billion to buffer European and other nations.

Europe has committed $150 billion to the IMF fundraising, with the rest of the $350 billion expected to come from other countries.

While European debt and austerity measures were undoubtedly at the heart of discussions, the tone of this year’s Davos meeting was decidedly about job creation.

Vikran Pandit, chief executive officer of Citigroup Inc., giving weight to the importance and impact of the euro financial crisis, which is “costing us about 1 percent in GDP around the world,” said, “You do the math. You do the math and say: ‘How many jobs is that? How many people are not working because of that? What can we do to go after the biggest question we’ve got for this decade which is jobs?’”

In other words, Pandit argued that job creation should be one of the key fixes for the economic crisis. He believes that 400 million new jobs are needed in the next decade, and that should be a “No. 1 priority” for governments worldwide.